What’s my “cost”?16753

Pages:

1

I snorted just a little. I snorted just a little.

|

jaysonslade private msg quote post Address this user | |

| If I’m bringing comics from the PC (that I’ve had for over 10 years) and moving them into my “for sale inventory”, what’s the preferred method to establish “cost” so that I can properly account for income tax when the book sells? Let’s say I paid $5 and it’s been in my hobby collection for 10 years. Is my “cost” still the $5? Or can I bring it into my collection for something more reasonable like what a current “dealer cost” might be like $300-400? Could I “purchase it from myself” for cash and account it in inventory for more? | ||

| Post 1 • IP flag post | ||

|

|

r_kruss private msg quote post Address this user | |

| I think you can add into the "cost" the amount you've spent for grading and/or encapsulation, including shipping and packaging charges. I don't think you can include anything else in your cost basis, but hopefully I'm wrong about that. | ||

| Post 2 • IP flag post | ||

" . " " . "

|

Davethebrave private msg quote post Address this user | |

| Well, I can see accountants and tax planners are going to be at “full employment” for another decade+ | ||

| Post 3 • IP flag post | ||

I'd like to say I still turned out alright, but that would be a lie. I'd like to say I still turned out alright, but that would be a lie.

|

flanders private msg quote post Address this user | |

| As said above your cost would be the price you paid plus any fees for slabbing, pressing, shipping, etc. You can also deduct any collector's insurance premium, fees for collection management software such as CLZ, fees for price guide subscriptions (GPA, gocollect, etc) and costs for supplies (bags & boards, shipping materials, etc) as business expenses so you can properly calculate your total income. | ||

| Post 4 • IP flag post | ||

Where's his Bat-package? Where's his Bat-package?

|

Byrdibyrd private msg quote post Address this user | |

Quote:Originally Posted by flanders Like this. Also add any storage fees you may have, such as a storage unit, or possibly the square footage you are using to store the books if you are self-employed. I recommend speaking with an accountant. |

||

| Post 5 • IP flag post | ||

I've spent years perfecting my brand of assholery. I've spent years perfecting my brand of assholery.

|

DrWatson private msg quote post Address this user | |

| You only need to establish a cost if you plan on selling the item. In addition, you only need to worry about that if you are selling or accepting payment through a venue that would be providing a 1099 at the end of the year and you received $600 or more in a calendar year. That being said, if you are going to buy, sell, and make a profit as if you are a comic book dealer, then you should be prepared to pay taxes as as if you are a comic book dealer. Another thing to keep in mind is there are hobby laws and you should have your accountant look into those. |

||

| Post 6 • IP flag post | ||

Masculinity takes a holiday. Masculinity takes a holiday.

|

EbayMafia private msg quote post Address this user | |

| "cost" is what you can prove if you get audited. Or it's what you can claim if you don't get audited. Most of us don't have a lot of proof of cost for books purchased years ago. So make extra effort to avoid getting audited. Don't be greedy, pay taxes on a reasonable amount of profit. Limit your sales to where they aren't an overly significant portion of your taxable income. | ||

| Post 7 • IP flag post | ||

I'm waiting.... (tapping fingers). I'm waiting.... (tapping fingers).Splotches is gettin old! |

Nuffsaid111 private msg quote post Address this user | |

| Cash Only. I haven't sold one item on any online platform since Dec 31 |

||

| Post 8 • IP flag post | ||

I have a problem with fattening women up. I have a problem with fattening women up.

|

Bronte private msg quote post Address this user | |

| That's not slways feasible. I can't imagine selling a 10k book to some guy counting 20 dollar bills.... | ||

| Post 9 • IP flag post | ||

Not trying to be an ass since February 12, 2020. Not trying to be an ass since February 12, 2020.

|

HulkSmash private msg quote post Address this user | |

Quote:Originally Posted by Nuffsaid111I haven’t either. I pulled my last item off eBay at the end of the month. I’m currently weighing platforms to sell on. For the time being I’ll be posting here, but it’s probably stuff no one here wants so I won’t have keep track of much if any. @jaysonslade good luck  |

||

| Post 10 • IP flag post | ||

I'm waiting.... (tapping fingers). I'm waiting.... (tapping fingers).Splotches is gettin old! |

Nuffsaid111 private msg quote post Address this user | |

| I dont tend to deal with books in the several thousand dollar range. So it's currently working for me. And when the time comes for my several thousand dollar books, I'll find a way. I refuse refuse refuse to allow my 35 year collection to be considered "$0 inventory". When they make it fair, I'll make it fair |

||

| Post 11 • IP flag post | ||

Masculinity takes a holiday. Masculinity takes a holiday.

|

EbayMafia private msg quote post Address this user | |

Quote:Originally Posted by Nuffsaid111 Same. I am going to be selling some items through MCS, but it will be almost exclusively items that I purchased from them. I printed out my purchase summary from MCS for the last 3 years...it was 18 pages. I will pay taxes on the gains, but at least I have my true cost summary. If anyone buys through MCS I suggest you print out your purchase history. I can give you instructions if you can't figure it out. |

||

| Post 12 • IP flag post | ||

I'm waiting.... (tapping fingers). I'm waiting.... (tapping fingers).Splotches is gettin old! |

Nuffsaid111 private msg quote post Address this user | |

Quote:Originally Posted by EbayMafia Exactly this. Those SOB's at the top know full well people didn't keep their receipts from the 70s 80s 90s and early 2000s. No one. Not just comics, but every damn thing in one's household. And now they're going to tax my grandmother on her $1000 China that she sells for $650 because she didn't have her receipt from 1966? To $%&# with them... seriously |

||

| Post 13 • IP flag post | ||

I've spent years perfecting my brand of assholery. I've spent years perfecting my brand of assholery.

|

DrWatson private msg quote post Address this user | |

Quote:Originally Posted by Bronte I would even take it in pennies. |

||

| Post 14 • IP flag post | ||

I have a problem with fattening women up. I have a problem with fattening women up.

|

Bronte private msg quote post Address this user | |

| @DrWatson Maybe if we met inside a bank... |

||

| Post 15 • IP flag post | ||

Masculinity takes a holiday. Masculinity takes a holiday.

|

EbayMafia private msg quote post Address this user | |

Quote:Originally Posted by Nuffsaid111 You raise an interesting point. I worry that there is a more nefarious plan in place. Even if grandma did have the receipts, it's not going to prevent her from getting audited if she shows a bunch of revenue with no profit. The receipts are not submitted with the tax return. The receipts don't even come into play until you are audited. And once you are under audit...all kinds of nasty things can happen. They can dig back through your entire tax reporting history looking for errors. I'm concerned that the real plan is to turn the IRS into a Proctology clinic and get a good look up at the innards of many more citizens than they have been for the past couple decades. |

||

| Post 16 • IP flag post | ||

I'd like to say I still turned out alright, but that would be a lie. I'd like to say I still turned out alright, but that would be a lie.

|

flanders private msg quote post Address this user | |

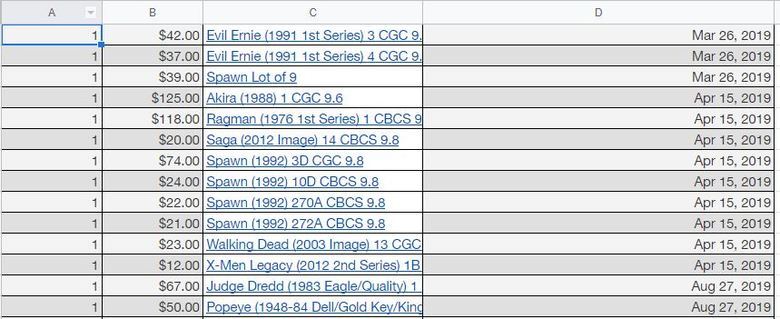

Quote:Originally Posted by EbayMafia I gave this a try. MCS keeps track of all the items I've ordered except my monthly pre-orders, but they don't keep track of invoices past a year (I should have paper receipts for all of these if I haven't thrown them away). At least I can see what I paid for the books before tax, shipping and any buyer's premium and those aren't hard to estimate. $7,419.30 is my total pre-tax/shipping/premium since March 2019. I don't even want to know how much I've spent on pre-orders that have ended up being worthless. |

||

| Post 17 • IP flag post | ||

Masculinity takes a holiday. Masculinity takes a holiday.

|

EbayMafia private msg quote post Address this user | |

Quote:Originally Posted by flanders @flanders When I click on "all items ordered" and then click on "sort by date shipped" I get a list that goes back to July 2019...which is when I made my first MCS purchase after about a 10 year hiatus. |

||

| Post 18 • IP flag post | ||

I'd like to say I still turned out alright, but that would be a lie. I'd like to say I still turned out alright, but that would be a lie.

|

flanders private msg quote post Address this user | |

| @EbayMafia I've got that too. I wanted to clarify that there's no invoice for the purchases online that breaks down the cost, tax, premium, shipping and final payment, unless it's within a year. I was actually able to copy and paste all the items I ordered into google sheets and the cool thing is it also copies the links to the original sales which still show images of the books even as far back as 2019.  |

||

| Post 19 • IP flag post | ||

Masculinity takes a holiday. Masculinity takes a holiday.

|

EbayMafia private msg quote post Address this user | |

| Oh wow, you're way ahead of me. I just have 9 sheets of paper printed front and back. I plan to just add 10% for sales tax and shipping to get a net cost. | ||

| Post 20 • IP flag post | ||

It's like the Roach Motel for comic collectors. It's like the Roach Motel for comic collectors.

|

chester15 private msg quote post Address this user | |

| Just use the new 2-step short form from the IRS: 1.) What did you have for sales last year? _________ 2.) Send it in. |

||

| Post 21 • IP flag post | ||

I'd like to say I still turned out alright, but that would be a lie. I'd like to say I still turned out alright, but that would be a lie.

|

flanders private msg quote post Address this user | |

| @EbayMafia it takes seconds to copy and paste to google. I wasn't sure if it would work, but I was easily able to see how much I've pissed away over the last 3 years. I've done a half assed job of keeping track of sales and net income since then, but this will be my first year I'll be keeping accurate records. So far this year, my income before any business expenses are deducted is a measly $175. |

||

| Post 22 • IP flag post | ||

Pages:

1This topic is archived. Start new topic?