Is the great test coming?16725

Leftover Sundae Gnus Leftover Sundae Gnus

|

CatmanAmerica private msg quote post Address this user | |

Quote:Originally Posted by michaelekrupp All collectibles have some degree of risk associated, but that risk can usually be tied to numbers and rabid market interest fueled by a variety of factors such as media interest. Bubbles occur when there are too many folks risking capital on speculative popularity (perceived size). When combined with too much quantity to maintain consistent growth or level of interest, risk of the bubble collapsing increases.  For most collectibles, smaller quantities and higher grades can be equated with more stable, long term interest and less risk. Your observations are spot-on, IMO. |

||

| Post 26 • IP flag post | ||

" . " " . "

|

Davethebrave private msg quote post Address this user | |

| @CatmanAmerica @michaelekrupp I agree. I would rather hold one of <100 copies of the world’s first introduction to what is the most important new fictional character of the last 100 years than $3 or $4 million cash. People will likely look back in 20 years and wonder why they sold for so little given their rarity + importance. Extreme example but illustrates the point. OTOH books available in the tens of thousands where dollars are chasing purely future dollars based on trends - we may be near a day of reckoning. I flip through my baseball card collection from the 80s and 90s and on market(risk)-adjusted terms they are worth maybe 0.1-1% of what they were worth back then. So a 99% decline in investment value. Mickey Mantles, Honus Wagners etc… well, I would have done just fine buying them up even during the peak of that era’s bubble. They would have produced returns in line with or better than the market. That is one heck of a divergence in the same class of collectibles. |

||

| Post 27 • IP flag post | ||

" . " " . "

|

Davethebrave private msg quote post Address this user | |

| The one part I disagree with is “grade” mattering as much over time. I think that the hierarchy will shift more and more towards “issue scarcity overall” combined with “issue long term impact” and away from more artificial notions of grade, variant etc. Truly unique error type variants on already scarce books - sure those will be a premium. But 9.6 vs 9.8 distinction… meh | ||

| Post 28 • IP flag post | ||

Collector Collector

|

michaelekrupp private msg quote post Address this user | |

| @Davethebrave In the case of silver age comics, it is worth considering that there is a substantially higher supply of low to mid grade copies in existence relative to higher grades. My experiences lead me to believe that pre-1964 books seem to be notably scarcer in grade. That seems to be the point where collectors started saving significant amounts of new copies. Ultimately, condition will always determine value, but in the case of more modern books, particularly the modern 9.6 / 9.8 phenomenon, a hard reality check is coming. There is no scarcity of books in this vintage in high grade and it seems to me that people who are into these value the labels more than the books. What is the real difference between a 9.6 and a 9.8? Often it is simply who graded it and on what day. I fully expect the bottom to fall out in this area of the hobby. | ||

| Post 29 • IP flag post | ||

Collector Collector

|

Oxbladder private msg quote post Address this user | |

| Personally, the only thing that's going to happen is the market on bronze through moderns market will cool. There will be no crash. There's nothing to fuel a 90's crash. Publication numbers have remained low with the only added component being lots of variants, which, currently, people still want. Paper shortages, other supply chain issues, damage and second print policies are all factors developing out of this pandemic. Sure sales on some things are high but that isn't across the board and they aren't going to remain that way because we are still dealing with this pandemic and as soon as regular life resumes that extra money being thrown around will diminish. Things have already slowed down quite a bit. The exclusive variant market has notably dropped in my area for example. The most important thing is that there are not a huge added group of people in the hobby like the 90's. The crash of the card market drove an influx of collectors to try their hand at comics. They fueled the increase in the market then. Sure there was some input from publishers, stores, and collectors, there always is, but the exodus of these added "collectors" created a serious problem in that stores had to order two months in advance and that mean that for everyone bailing out in the intervening time lead to extra copies on shelves and bins. It took several months for stores and publishers to catch up. On the back side of this came exclusive distributing which was the death knell of many retail outlets. There's no doubt in my mind that the money coming in now is going to slow down but I seriously doubt that there will be any crash like we saw in the market in the 90's. Some books will drop in value but anything that has exceeded the $300-500 range isn't going to drop to under $100 or less. I can see lots of books plateauing including books from the the silver and gold ages. There are lots and lots of untapped potential in existing material though that a huge crash just doesn't seem logical to me. While bronze books have been increasing in value there are still many good investment areas same with gold and silver books. Then there's still lots of room for 80's, and 90's books to increase. While supply is good it is not as easy to find many books in 9.0 or better because of the hobby's habit of labeling all modern books as useless drek. As such, lots of book ended out unbagged and boarded in cheap book boxes all over the continent. Heck there's tons more demand to be created and eventually it will happen, just like Canadian Newsstand and additional printings are now a thing (odd it doesn't stretch to the war time Canadian printings, not the Canadian whites, but actual Canadian printings of US books, it hard to find these now and especially in higher grades than VG). Anyway, I will stop there. As long as new stuff keeps coming out I am happy. I'm not in this for the money but I will readily admit that it is a nice perk. |

||

| Post 30 • IP flag post | ||

Masculinity takes a holiday. Masculinity takes a holiday.

|

EbayMafia private msg quote post Address this user | |

| Right now for modern books that gain traction I see a common ratio of 1-3-5. Meaning that One 9.8 has market value equal to Three 9.6 and Five 9.4. When a modern book with plenty of supply gains traction because it has introduced a new character that is gaining in importance, I'm not so sure that $80 for a 9.4 is out of whack. The $135 for a 9.6 also seems not too unreasonable to me. It's the $400 for the 9.8 that catches attention and makes us feel that the books are significantly over-valued and in need of a correction. If we stopped looking at 9.8 prices and started with 9.4, I wonder how many people would feel that the price for popular moderns is all that far out of whack. | ||

| Post 31 • IP flag post | ||

" . " " . "

|

Davethebrave private msg quote post Address this user | |

| On the collector car side the most recent auctions (Eg Mecum) show zero signs of slowing despite the big hits on crypto and equities. Cars are fetching multiples of 2-3x what they traded at just two years ago… My crypto portfolio is now down roughly 50% from peak values. That is roughly indicative of that market overall. Edit: crypto down more like 55% vs peak… minute to minute :-) |

||

| Post 32 • IP flag post | ||

Collector* Collector*

|

Towmater private msg quote post Address this user | |

| Doesn't it all one down to whether you believe the comic book hobby is in a bubble? If you don't, don't be concerned. If you do, it all boils down to where you think the activity is in the bubble's lifetime. (Displacement, boom, euphoria, profit-taking, and panic are the five phases of a bubble.) Then one must include one's thoughts on whether the explosion will be wide-spread or localized when it occurs. I see the comic book hobby, as well as other hobbies, as being in the euphoria phase. At the moment, prudence is being disregarded. The next "big sucker" will go out and buy the next pricey comic book or OA item. The question to ask and answer is how many more "big suckers" are still in whatever line you hold items. If you don't depart at the correct time, you'll be stuck with an overpriced book/item that no one wants to buy. You are the last "big sucker" at that point. |

||

| Post 33 • IP flag post | ||

" . " " . "

|

Davethebrave private msg quote post Address this user | |

| @Towmater did you see my post above on collectible sports cards? The 90s was a massive bubble for both cards and comics. If you bought truly rare books or cards, however, you barely were impacted (near term) and in fact would have done exceptionally well in the medium and long term continuing to hold. Market timing is notoriously difficult and also notoriously unprofitable. Asset allocation and investment class segmentation and rotation can, however, help achieve excess returns. Splitting investment areas into different segments is doable. It takes some understanding of how to truly value comic issues (hint, it isn’t how much each individual comic sells for in the market) and also the types of collectors and what they are valuing. I agree the market as a whole is a bubble. So are all markets. Cash is, however, the asset the suffers the most… it is doing very poorly. So, when all things are expensive, what segments likely have greater permanence? Also, when fear grips, where will funds flow into (or not flow out of)? |

||

| Post 34 • IP flag post | ||

" . " " . "

|

Davethebrave private msg quote post Address this user | |

| Another way to say this - when everything goes up, no-one (or few) get richer. My Canadian friends can relate. If your house doubles in value, but so does the “nicer” house down the street.. are you truly wealthier? Unless you can sell and leave the market, you are not truly wealthier. In fact, when other associated expenses increase, you may be in a worse financial position. However, you may be better off than not owning or even buying in… the issue becomes ability to weather unwinds and deflationary impacts. It is complex and simple at the same time. The simple part is that your choice is a false one when everything is overpriced. To me it comes more a question of risk management and selecting the least risky of the options. You can “exit” the game too (go fully into cash) but that is objectively no less risky. Just a different type of risk and one that unfortunately runs counter to political will… |

||

| Post 35 • IP flag post | ||

Collector Collector

|

cesidio private msg quote post Address this user | |

| No one knows what is going to happen. Analyze the situation across a variety of investment opportunities and make up your own mind. Me personally I buy the assets that are down and sell the ones that are up. When it comes to stocks it's a gamble. Collectibles: comics, sports cards, coins, stamps, ect. Condition is every thing even if it's rare. Comics I focus on silver to bronze age high grades mostly marvel for obvious reasons. Moderns only variants 1:100 to 1:1000. To each their own. Point being buy what you want to buy but don't pay more than you want to; and certainty don't sell for less than what you want. | ||

| Post 36 • IP flag post | ||

being an ass and being a clown are two very different things. being an ass and being a clown are two very different things.

|

HAmistoso private msg quote post Address this user | |

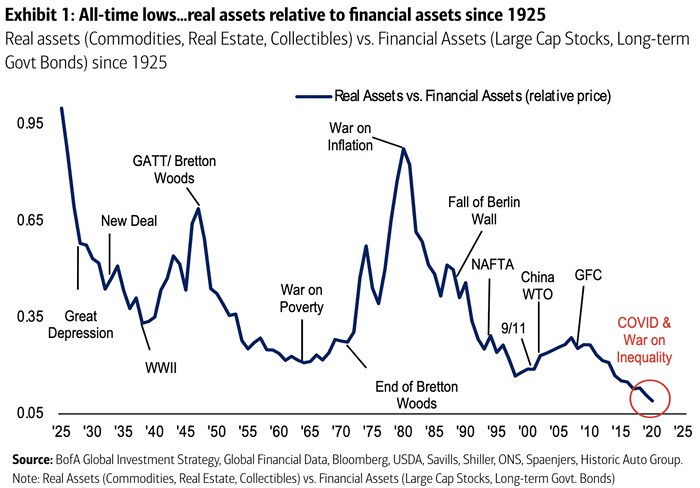

| There are 4 traditional investment classes: Stocks, Bonds, Real Estate, and Commodities. Only one of these has not achieved extreme historical valuation levels (yet?). | ||

| Post 37 • IP flag post | ||

" . " " . "

|

Davethebrave private msg quote post Address this user | |

Quote:Originally Posted by WMorse Actually, all have. Just depends which sub-class you consider (and which regions for real estate). |

||

| Post 38 • IP flag post | ||

being an ass and being a clown are two very different things. being an ass and being a clown are two very different things.

|

HAmistoso private msg quote post Address this user | |

Not saying anymore about it, promise. |

||

| Post 39 • IP flag post | ||

Masculinity takes a holiday. Masculinity takes a holiday.

|

EbayMafia private msg quote post Address this user | |

Quote:Originally Posted by Davethebrave You are. Your balance sheet is stronger, your borrowing power is greater and the divide between you and non-homeowners has doubled. Many of my customers here in Southern California have blue collar jobs but they've been able to put both their kids and grandkids through the college of their choice because of the home they bought 40 years ago and never sold. Admittedly, interest rates have been historically low for the 30 years that I've been witnessing this. Higher rates could make it harder for someone to access that wealth without getting into the situation you describe. Quote: Originally Posted by cesidio Isn't condition really a second level of rarity? I don't agree with this though, as in real estate, location is everything. Having the right books is more important than having the wrong books in high grade. |

||

| Post 40 • IP flag post | ||

Masculinity takes a holiday. Masculinity takes a holiday.

|

EbayMafia private msg quote post Address this user | |

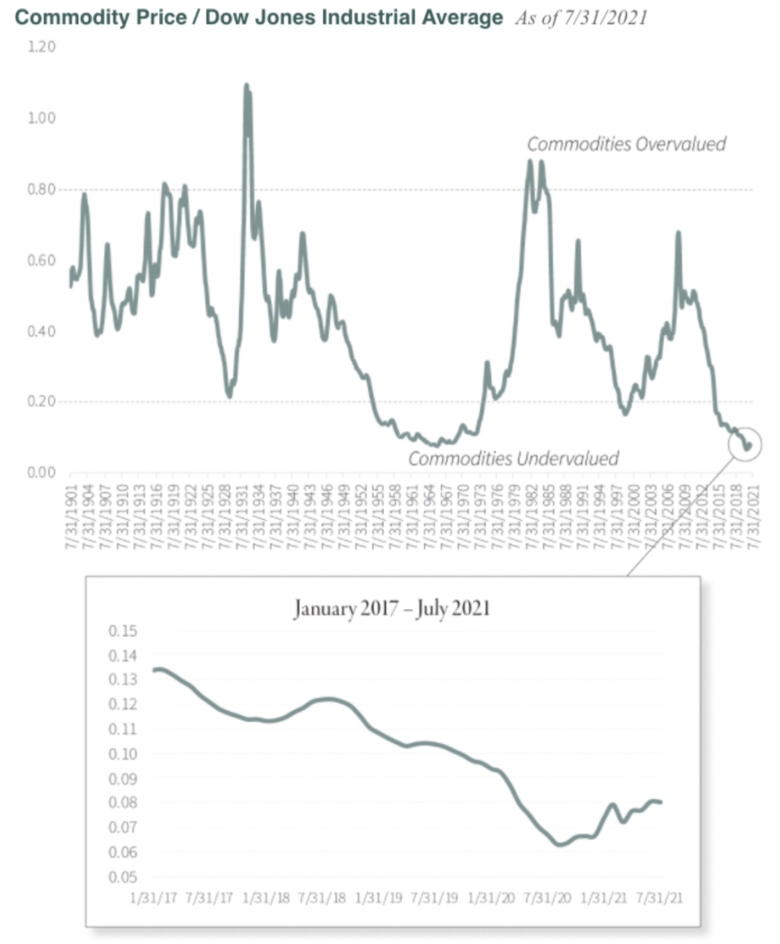

Quote:Originally Posted by WMorse @WMorse I think that chart tells us more about the stock market than it tells us about commodities. Basically when the stock market crashes (1929) commodity values appear to spike...but it's only relative to the crashing market price. And when the stock market spikes commodity values appear to tank...but again it is only in comparison to the spiking stock market price. Regardless of that, I agree with your premise. Commodities are under-valued relative to everything else and I can't understand why things like precious metals are getting no traction in the face of inflation. |

||

| Post 41 • IP flag post | ||

being an ass and being a clown are two very different things. being an ass and being a clown are two very different things.

|

HAmistoso private msg quote post Address this user | |

|

||

| Post 42 • IP flag post | ||

Masculinity takes a holiday. Masculinity takes a holiday.

|

EbayMafia private msg quote post Address this user | |

Quote:Originally Posted by WMorse Another chart that tells you a lot about the Denominator but not necessarily much about the Numerator. Stock Market up, Government borrowing up...chart down. |

||

| Post 43 • IP flag post | ||

being an ass and being a clown are two very different things. being an ass and being a clown are two very different things.

|

HAmistoso private msg quote post Address this user | |

| Not saying anymore @EbayMafia. I keep my promises! | ||

| Post 44 • IP flag post | ||

Masculinity takes a holiday. Masculinity takes a holiday.

|

EbayMafia private msg quote post Address this user | |

| @WMorse Two diverse pieces of information should not be presented on a single line graph. It should be presented as two lines that would allow the audience to see that one line is relatively stable while the other line is relatively volatile or steep. Presenting it as a single line creates a false dichotomy in the eyes of the uneducated audience. It gives the impression that a rise in one has a negative impact on the other...which is not the case. | ||

| Post 45 • IP flag post | ||

being an ass and being a clown are two very different things. being an ass and being a clown are two very different things.

|

HAmistoso private msg quote post Address this user | |

| Would you rather be in the numerator or the denominator at this point in time @EbayMafia? | ||

| Post 46 • IP flag post | ||

being an ass and being a clown are two very different things. being an ass and being a clown are two very different things.

|

HAmistoso private msg quote post Address this user | |

| Post 47 • IP flag post | ||

Masculinity takes a holiday. Masculinity takes a holiday.

|

EbayMafia private msg quote post Address this user | |

Quote:Originally Posted by WMorse @WMorse The Denominator includes long-term government debt while the Numerator includes houses. I'm not really interested in holding government debt at 2%-3% interest, I do like having a 30 year mortgage at 3% Interest. To your point, I certainly would have been better off in the stock market than in precious metals over the last 2 years. But on the other hand, I don't think many homeowners wish they had been in the stock market rather than home ownership in the last 2 years. |

||

| Post 48 • IP flag post | ||

" . " " . "

|

Davethebrave private msg quote post Address this user | |

Quote:Originally Posted by WMorse As someone who put together plenty of charts like that in the past (to “good” effect) - they are meaningless absent context. Commodities are too general - as is the definition of “real assets”. Go look at home prices to income. For some markets the ratios are off the charts and at historical highs. Same with “real” assets like cars… see if it is a real asset or not ;-) In terms of commodities, look at producer price indices or certain commodities that are heavily used in current hot markets - at or near historic highs. Copper, all time high. Iron, all time high. Obviously rare earth materials are at decade highs (or all time)… Like I said many times, you have to slice these markets. Looking at ratios vs stock indexes - both can be at historic highs - it just means one (or slices of one) are bubblier than the other (as a whole). |

||

| Post 49 • IP flag post | ||

being an ass and being a clown are two very different things. being an ass and being a clown are two very different things.

|

HAmistoso private msg quote post Address this user | |

Are you sure @EbayMafia? |

||

| Post 50 • IP flag post | ||

Masculinity takes a holiday. Masculinity takes a holiday.

|

EbayMafia private msg quote post Address this user | |

Quote:Originally Posted by WMorse Yeah, I'm sure. I think you are misunderstanding the inclusion of Long-Term govt bonds in the growing Denominator. It doesn't mean people are getting rich on them. It just means that governments are issuing an ever-increasing amount of them. |

||

| Post 51 • IP flag post | ||

being an ass and being a clown are two very different things. being an ass and being a clown are two very different things.

|

HAmistoso private msg quote post Address this user | |

| Agreed, they are included in the numerator. Negative real rates certainly aren't the path to wealth! | ||

| Post 52 • IP flag post | ||

" . " " . "

|

Davethebrave private msg quote post Address this user | |

Quote:Originally Posted by EbayMafia Asset inflation wealth effects are in part illusory - a lot is premised on debt. Without taking out debt the only way you realize that wealth is by exiting the inflated system. That was the main point. Any accessing of the wealth then involves risk (leverage). Look, I am taking some admittedly extreme positions to illustrate points. I like real estate and my family benefited (in theory) by massive price inflation in Canada and S California. But unless we sell or leverage the homes there is zero “wealth” realization. Because everything nearby has gone up… Expenses increase, daily enjoyment or the ability of my parents to actually live a wealthy lifestyle… zero benefit. That is the reality for most Canadians. There is a haves vs have nots too - for sure… but that is just saying that there is worsening conditions (and more resource or wealth polarization). |

||

| Post 53 • IP flag post | ||

" . " " . "

|

Davethebrave private msg quote post Address this user | |

| Btw, all of this (house price growth, stock market bubbles, collectibles, etc) is due to massive liquidity - low rates through artificial global government intervention to avoid an asset value collapse in 2008-2009. That’s it. That is a tenuous basis for wealth creation. The only source of real wealth creation in any economic system is through productivity growth. That is it. Productivity growth has been rather pathetic over the past couple decades. It is that disconnect that causes concern. |

||

| Post 54 • IP flag post | ||

being an ass and being a clown are two very different things. being an ass and being a clown are two very different things.

|

HAmistoso private msg quote post Address this user | |

| Some are waiting on the sidelines @Davethebrave. The great test has been ongoing... | ||

| Post 55 • IP flag post | ||

This topic is archived. Start new topic?