Is the great test coming?16725

Masculinity takes a holiday. Masculinity takes a holiday.

|

EbayMafia private msg quote post Address this user | |

Quote:Originally Posted by WMorse Yeah, I'm sure. I think you are misunderstanding the inclusion of Long-Term govt bonds in the growing Denominator. It doesn't mean people are getting rich on them. It just means that governments are issuing an ever-increasing amount of them. |

||

| Post 51 • IP flag post | ||

|

HAmistoso private msg quote post Address this user | |

| Agreed, they are included in the numerator. Negative real rates certainly aren't the path to wealth! | ||

| Post 52 • IP flag post | ||

" . " " . "

|

Davethebrave private msg quote post Address this user | |

Quote:Originally Posted by EbayMafia Asset inflation wealth effects are in part illusory - a lot is premised on debt. Without taking out debt the only way you realize that wealth is by exiting the inflated system. That was the main point. Any accessing of the wealth then involves risk (leverage). Look, I am taking some admittedly extreme positions to illustrate points. I like real estate and my family benefited (in theory) by massive price inflation in Canada and S California. But unless we sell or leverage the homes there is zero “wealth” realization. Because everything nearby has gone up… Expenses increase, daily enjoyment or the ability of my parents to actually live a wealthy lifestyle… zero benefit. That is the reality for most Canadians. There is a haves vs have nots too - for sure… but that is just saying that there is worsening conditions (and more resource or wealth polarization). |

||

| Post 53 • IP flag post | ||

" . " " . "

|

Davethebrave private msg quote post Address this user | |

| Btw, all of this (house price growth, stock market bubbles, collectibles, etc) is due to massive liquidity - low rates through artificial global government intervention to avoid an asset value collapse in 2008-2009. That’s it. That is a tenuous basis for wealth creation. The only source of real wealth creation in any economic system is through productivity growth. That is it. Productivity growth has been rather pathetic over the past couple decades. It is that disconnect that causes concern. |

||

| Post 54 • IP flag post | ||

|

HAmistoso private msg quote post Address this user | |

| Some are waiting on the sidelines @Davethebrave. The great test has been ongoing... | ||

| Post 55 • IP flag post | ||

" . " " . "

|

Davethebrave private msg quote post Address this user | |

Quote:Originally Posted by WMorse Hey, I have been forthright about my positions. :-) I hold assets I think are bubbly. I always try to select “the best of the bunch”… but doesn’t mean I avoid risk. I always keep dry powder for opportunities. Be fearful when others are greedy… and greedy when others are fearful :-) |

||

| Post 56 • IP flag post | ||

|

HAmistoso private msg quote post Address this user | |

| What a Great Forum! | ||

| Post 57 • IP flag post | ||

Masculinity takes a holiday. Masculinity takes a holiday.

|

EbayMafia private msg quote post Address this user | |

| So, I don't know if all this side discussion got us closer to an answer. Is the great test coming? One thing we learned in 2020 is that a lack of productivity doesn't necessarily lead to an immediate lack of currency. On the whole, I still don't see comic books as more risky than currency. | ||

| Post 58 • IP flag post | ||

" . " " . "

|

Davethebrave private msg quote post Address this user | |

Quote:Originally Posted by EbayMafia This I agree with. But only certain comics ;-) |

||

| Post 59 • IP flag post | ||

Leftover Sundae Gnus Leftover Sundae Gnus

|

CatmanAmerica private msg quote post Address this user | |

Quote:Originally Posted by EbayMafia Currency may be riskier; we should seek second opinions from numismatists! . |

||

| Post 60 • IP flag post | ||

Please continue to ignore anything I post. Please continue to ignore anything I post.

|

southerncross private msg quote post Address this user | |

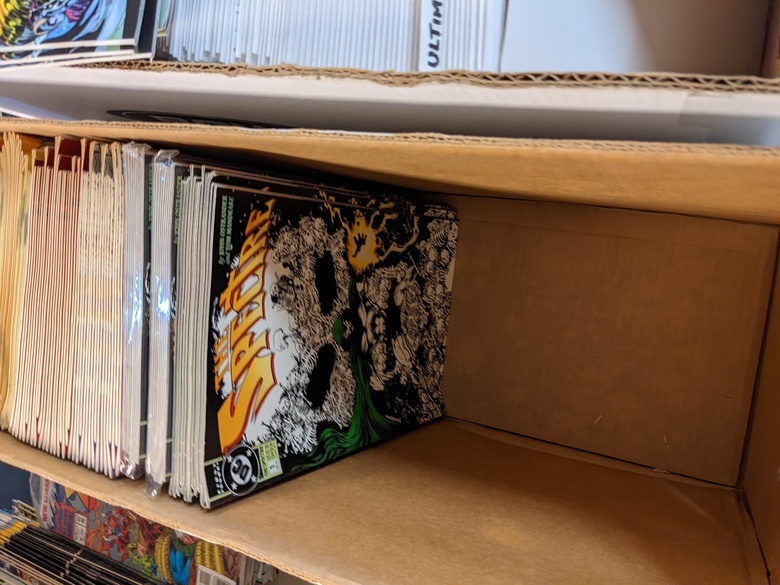

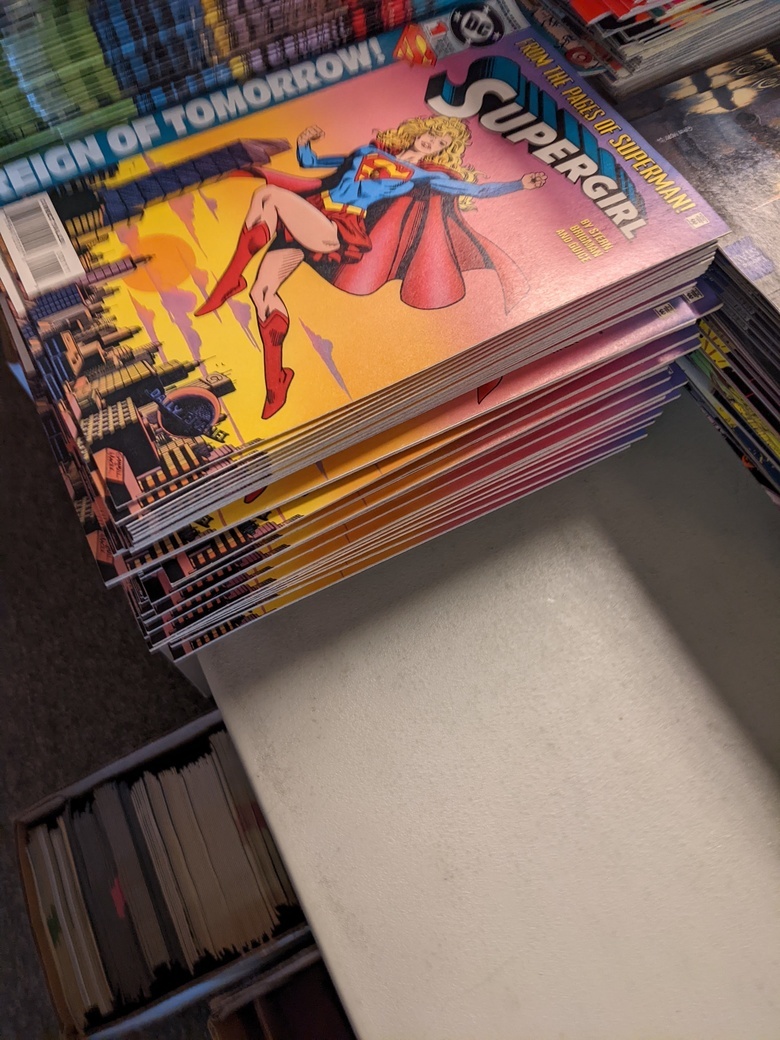

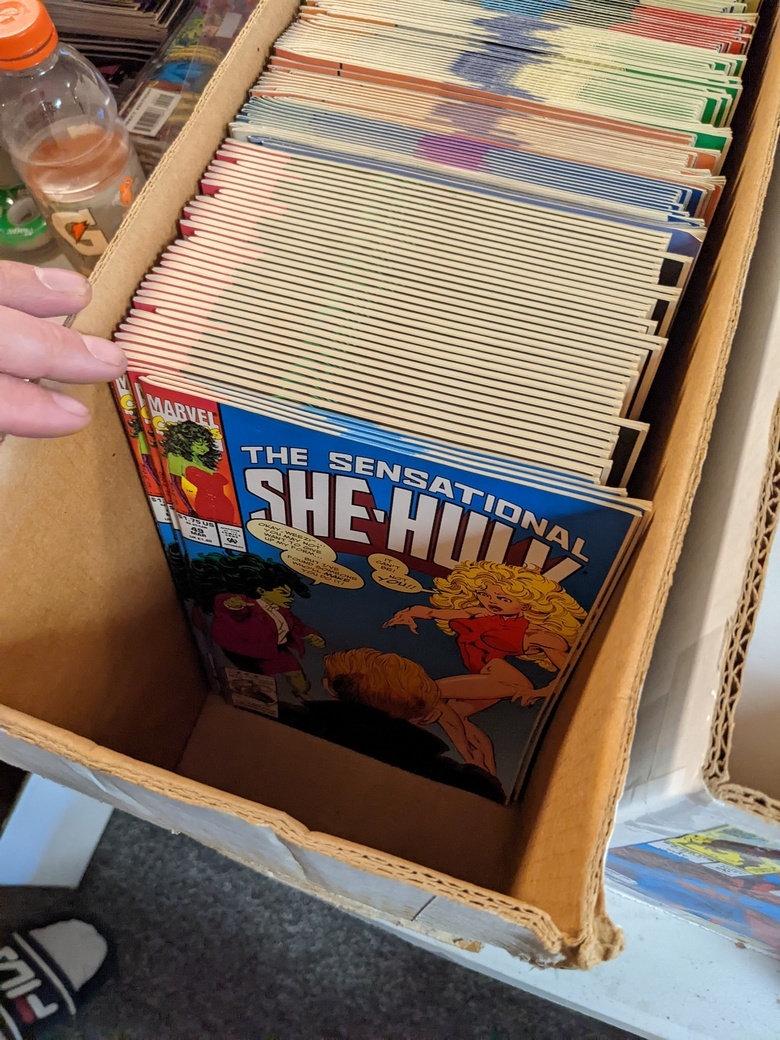

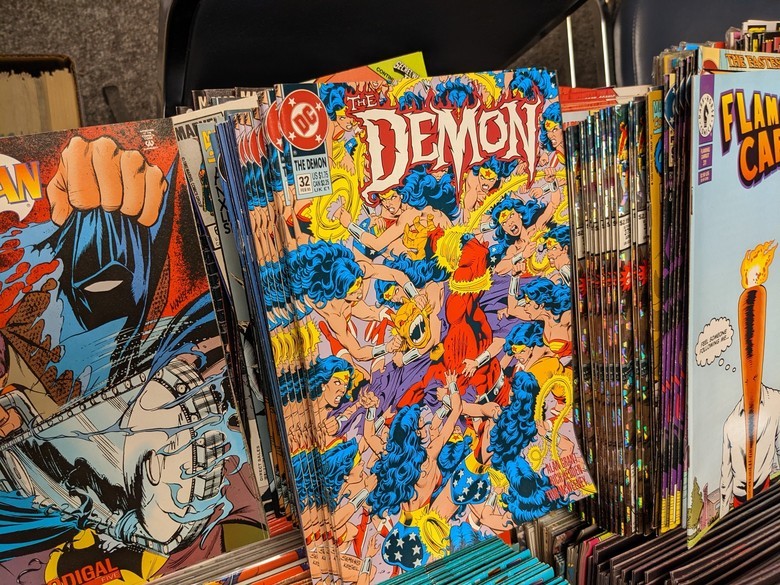

| I remember the glut of the 90s. Here is a few pics of 90s books my lcs picked up in a massive old stock store that closed it's doors in the 90s          |

||

| Post 61 • IP flag post | ||

Masculinity takes a holiday. Masculinity takes a holiday.

|

EbayMafia private msg quote post Address this user | |

| @southerncross Only one copy of Flaming Carrot in those pics. You see, that's why y'all need to jump on Flaming Carrot. | ||

| Post 62 • IP flag post | ||

Please continue to ignore anything I post. Please continue to ignore anything I post.

|

southerncross private msg quote post Address this user | |

| Oh I didn't see that. I saw 5 long boxes sorted thru but I think there is another 50 long boxes, think all up there was 100 and there's about 400 books per box, I grabbed some books at cover price and a couple for free |

||

| Post 63 • IP flag post | ||

Please continue to ignore anything I post. Please continue to ignore anything I post.

|

southerncross private msg quote post Address this user | |

|

||

| Post 64 • IP flag post | ||

Collector Collector

|

TommyJasmin private msg quote post Address this user | |

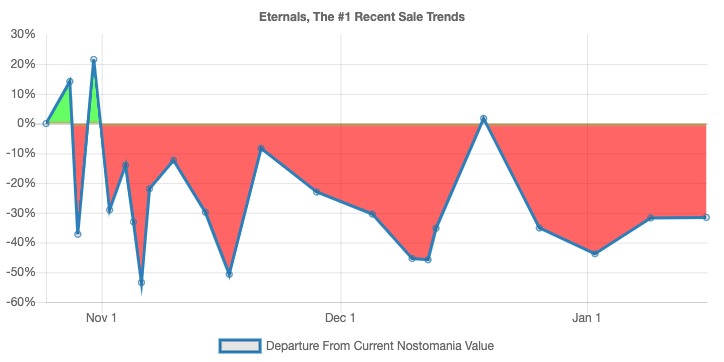

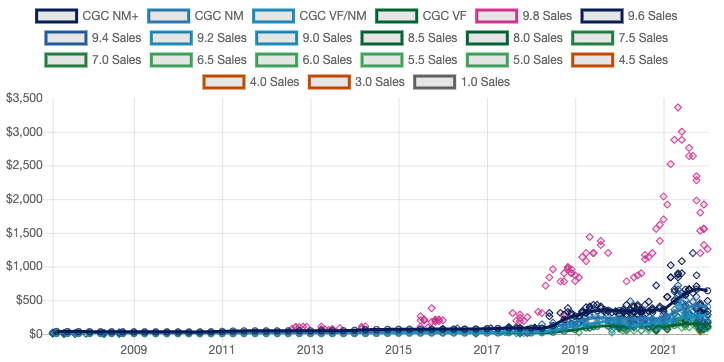

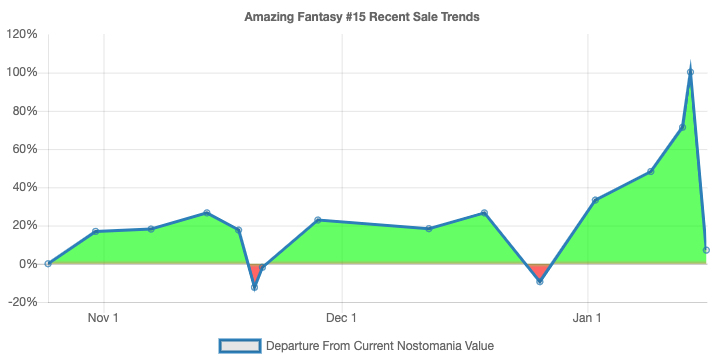

Great thread, great discussion everyone. Too much to comment on and I agree with most of it anyway, so I'll just throw out a few bits of data. Let's look at a couple recent Marvel movies, and their key comic analogies. I didn't see The Eternals, but looking at data for Eternals #1, I'm guessing it must not have been that great: It's really unusual right now to see a single comic plummet that much. Looking just at graded 9.8 copies, I would call that a bubble of sorts, going from under $1,000 in mid-2020, approaching $3,500 mid-2021, but now dropping off quickly to around $1,200 this month.  Contrast with another recent Marvel movie (Spider-Man) that did really well, and AF #15 is stronger than ever:  I know, it's AF 15, of course it's strong. But the average grade in that chart is VG. Ties to points many of you made about how much grade matters. Of course it matters, but more and more people are happy with any copy. Who among us two years ago saw that collectors would be paying $60-$70K (or more!) for 4.5 AF 15s today? |

||

| Post 65 • IP flag post | ||

" . " " . "

|

Davethebrave private msg quote post Address this user | |

| @TommyJasmin interesting data and the theme to me is durability of value. When you have values based on near term cultural impacts with questionable sustainability and no scarcity… I fear the values won’t hold. Spider-man is not more or less culturally relevant if a movie makes $2bn or $500m. At this point he is iconic. The supply of AF15 is quite high (census) and lots of uncertified copies left too. Price movements around movie releases for an issue like that is just - silly. Now, if people are parking cash because they view it as a blue chip investment - fine. That demand may spike and could have some durability. But it should not correlate to box office at all. My math says AF15 is overvalued but not massively so (may decline 50%, for example, not 90%). This is because of comparison to AC1. As I pointed out a while back, the AF15 at $3.8m (regardless of grade) suggested a massive upward revaluation of AC1. This is why I expected the 6.0 auction to exceed $3M (which it did), matching the price for the much higher grade sale less than a year ago. The higher AF15 suggest AC1 is still massively undervalued… I see much better upside vs downside prospects for that book even after the AF15 driven revaluation. Even though AF15 prices may be irrational and therefore a key driver under AC1’s revaluation is therefore by extension irrational. The catalyst is less important than fundamentals… Price action like what you flag for Eternals is another example of absurd MCU spec fervor detached from durable value. Even if Eternals had been a hit there is too little long-term cultural impact and far too much supply to justify those issue prices. I wouldn’t put any serious $ into Marvel titles today. DC titles generally didn’t get nearly the boost and inflation adjusted (and scarcity adjusted) don’t look bad vs even 20 years ago. Everything is “expensive” but in some ways it just tells us how much our dollars have depreciated in real buying power :-/ |

||

| Post 66 • IP flag post | ||

|

HAmistoso private msg quote post Address this user | |

|

||

| Post 67 • IP flag post | ||

Masculinity takes a holiday. Masculinity takes a holiday.

|

EbayMafia private msg quote post Address this user | |

Quote:Originally Posted by TommyJasmin Exactly. Location matters, quality of the house is secondary. Comic books are a micro-version of real estate. Better to own the cheapest house in a highly desirable neighborhood than the most expensive house in a lousy neighborhood. Hard to imagine anyone is thrilled that they bought the 9.8 Eternals #1 for $2,500 instead of the 9.4 copy for $400. Can't imagine there can be enough pride of ownership to make up that $2,100 difference. |

||

| Post 68 • IP flag post | ||

Masculinity takes a holiday. Masculinity takes a holiday.

|

EbayMafia private msg quote post Address this user | |

Quote:Originally Posted by TommyJasmin Even if the movie had been a hit, I think a drop-off in demand was predictable, just would have taken an extra 6-12 months. Eternals #1 is available in huge supply with thousands of copies that were never even read. Buyers would have lost interest and changed focus within a year. Consider, Marvel Preview #4, first appearance of Starlord. After the movie was a hit it reached a high in 9.8 of about $3,000. In the time between movies that 9.8 had settled to a low of $1,600. And that was a huge hit movie with a book that is in limited supply. Granted, the magazine format may have limited potential buyers for the book. |

||

| Post 69 • IP flag post | ||

" . " " . "

|

Davethebrave private msg quote post Address this user | |

Quote:Originally Posted by WMorse I clearly agree. However, I could draw an eye opening infographic on computing power, network speed, data access and storage etc and it would be the inverse ;-) Or, if you “feature adjust” or performance adjust for certain big ticket items like cars, TVs etc. There are also some interesting things to be learned by how economists adjust Inflation index “baskets” over time. |

||

| Post 70 • IP flag post | ||

This topic is archived. Start new topic?