Income tax question15799

I snorted just a little. I snorted just a little.

|

jaysonslade private msg quote post Address this user | |

| I really need some clarity on the whole income tax situation. I'd very much like to sell some of my comics as a side business in order to downsize the sheer volume of books I own, not necessarily to bring in a lot of actual spendable income. Not trying to avoid paying income tax at all, but trying to be as tax efficient as possible, I'd like to know if I sell from my current inventory (books I've owned for 2-20 years) and purchase new ones to replenish that inventory, can the new purchases be considered a business expense? My scenario: let's say I sell 15 books for a total of $10,000 (that I only paid $2000 for several years ago) and use that $10,000 to purchase a single $7,000 book to resell later, and keep the remaining $3000, am I allowed to claim only $1,000 as profit when I file my income tax? It seems like buying new inventory to sell later would be a legitimate business expense. Could someone break down this for me? | ||

| Post 1 • IP flag post | ||

I'd like to say I still turned out alright, but that would be a lie. I'd like to say I still turned out alright, but that would be a lie.

|

flanders private msg quote post Address this user | |

| This might help confuse you some more: https://notyourdadscpa.com/can-i-deduct-inventory-when-i-purchase-it/ |

||

| Post 2 • IP flag post | ||

Collector* Collector*

|

Towmater private msg quote post Address this user | |

| Go find a tax professional in your area and sit down and chat with them. That is the ONLY way you are going to get advice that covers you or your business. To do it any other way really isn't smart. | ||

| Post 3 • IP flag post | ||

Masculinity takes a holiday. Masculinity takes a holiday.

|

EbayMafia private msg quote post Address this user | |

Quote:Originally Posted by jaysonslade Inventory is an asset on the balance sheet. It doesn't move to the Profit and Loss statement until it's sold or written off as obsolete/unsellable. |

||

| Post 4 • IP flag post | ||

Collector* Collector*

|

Towmater private msg quote post Address this user | |

Quote:Originally Posted by EbayMafia You didn't ask if he has a federal tax ID number for his business, what type of business he is, if he is a business, if has a license, how he collects sales tax, and the plethora of other information needed to get a handle on what advice he or his business would/should follow. I am going to be so happy when the $ 600.00 line starts next year. |

||

| Post 5 • IP flag post | ||

Have I told you about the time I dropped off 3,000 comics at SDCC? Have I told you about the time I dropped off 3,000 comics at SDCC?

|

Scifinator private msg quote post Address this user | |

| @jaysonslade - as was mentioned, you need to hire a tax professional to guide you as to How to structure and go over the ramifications and costs fo doing so. If you are every audited, you will need that advisor as an advocate for you to argue why all was legit. | ||

| Post 6 • IP flag post | ||

past performance is no guarantee of future actions. past performance is no guarantee of future actions.

|

KatKomics private msg quote post Address this user | |

Quote:Originally Posted by Towmater ^^^^^^ this! |

||

| Post 7 • IP flag post | ||

I had no way of knowing that 9.8 graded copies signed by Adam Hughes weren't what you were looking for. I had no way of knowing that 9.8 graded copies signed by Adam Hughes weren't what you were looking for.

|

drchaos private msg quote post Address this user | |

| In real estate a like kind exchange works in the manner you describe where the purchase of a new property offsets the sale of another property. While you could deduct expenses such as shipping or grading fees when calculating your profit buying a different book does nothing to reduce your tax liability from the sale of your existing inventory. Even if you could find a tax professional to tell you what you want to hear you would still lose if you ever got audited. |

||

| Post 8 • IP flag post | ||

If the viagra is working you should be well over a 9.8. If the viagra is working you should be well over a 9.8.

|

xkonk private msg quote post Address this user | |

Quote:Originally Posted by jaysonslade Quote: Originally Posted by Towmater |

||

| Post 9 • IP flag post | ||

Masculinity takes a holiday. Masculinity takes a holiday.

|

EbayMafia private msg quote post Address this user | |

Quote:Originally Posted by Towmater What could I possibly find out that would make inventory not an Asset on the Balance Sheet? |

||

| Post 10 • IP flag post | ||

Collector* Collector*

|

Towmater private msg quote post Address this user | |

| @EbayMafia While it is an asset, in some states, and/or counties, and/or municipalities inventory has property taxes associated with it. Knowing how much, and when to sell it, or have it on hand are considerations that one needs to chat about with a tax professional to limit one’s exposure and to figure out what tax strategy works best. My local municipality has such an ordinance on the books. I don’t think your average Joe knows that, nor the percentages associated with the taxes owed on it, and when it is due. If you disagree with my advice to seek out a tax professional then we view the realities and liabilities of doing taxes incorrectly very differently. |

||

| Post 11 • IP flag post | ||

Masculinity takes a holiday. Masculinity takes a holiday.

|

EbayMafia private msg quote post Address this user | |

Quote:Originally Posted by Towmater I don't disagree with your advice, but it is general advice. @jaysonslade's question was specific and I can give him an answer to the question now, before he hires an accountant. The plan of avoiding taxes on collectibles profits by investing in new inventory will not work in an audit. Taxes are paid on profits. Those come from the Profit and Loss Statement. The P+L on a $10,000 sale will not be reduced by a subsequent $7,000 purchase. There are ways to minimize the tax liability, but the main goal has to be to avoid attracting an audit. The proposed plan would raise red flags. |

||

| Post 12 • IP flag post | ||

I've spent years perfecting my brand of assholery. I've spent years perfecting my brand of assholery.

|

DrWatson private msg quote post Address this user | |

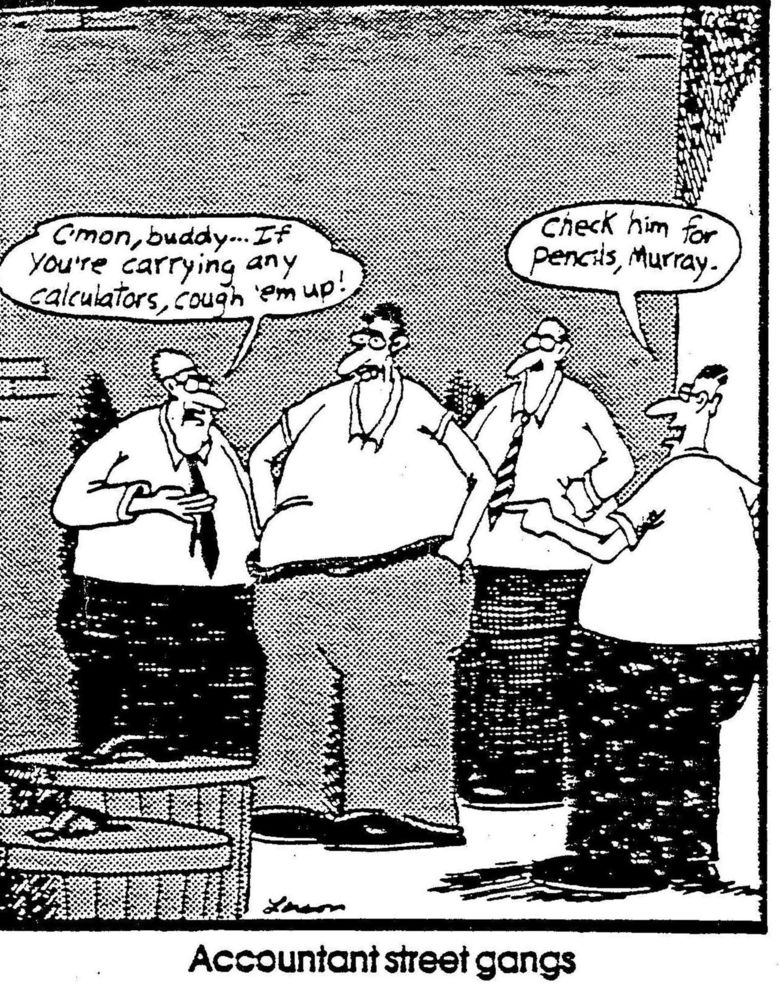

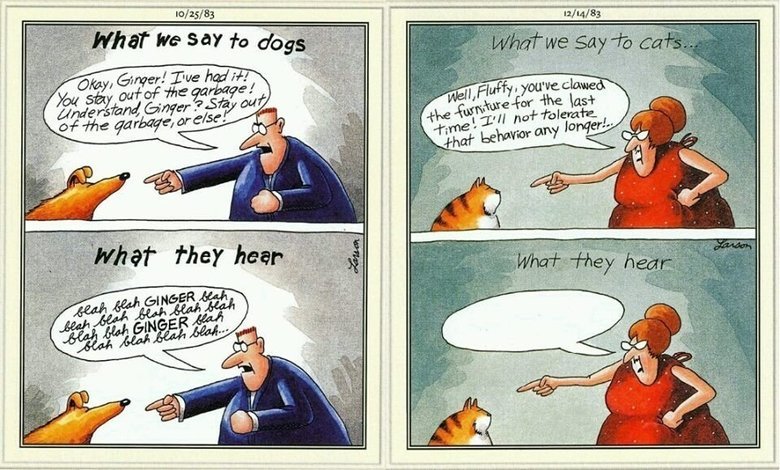

This thread reminds me of a couple of cartoons: |

||

| Post 13 • IP flag post | ||

Where's his Bat-package? Where's his Bat-package?

|

Byrdibyrd private msg quote post Address this user | |

| May I chime in on a couple points, this coming from a person not expert in taxes, but has been buying/selling for a while? 1) When you purchase inventory, you claim that loss upon the SALE of that very same inventory. This prevents 'double-dipping,' or claiming it both when you purchase AND sell the inventory. Trying to claim it when you buy it will make it look like your goal is double-dipping, and that will raise huge red flags. This brings me to my next point... 2) Everyone here who has been saying you need to hire a tax pro for this is CORRECT!!! You may not be able to claim anything for purchasing inventory for future sale, but there may be all kinds of other things you can claim that you never thought of, and a pro would know about that. |

||

| Post 14 • IP flag post | ||

Masculinity takes a holiday. Masculinity takes a holiday.

|

EbayMafia private msg quote post Address this user | |

Quote:Originally Posted by Byrdibyrd @Byrdibyrd you are absolutely correct, I changed your word "loss" to "expense", it's not always a loss but it is always an expense. At the time of sale the inventory moves off the Balance Sheet (where it is an asset) and onto the Profit and Loss statement, at cost (where it is an expense that reduces your profit). |

||

| Post 15 • IP flag post | ||

Where's his Bat-package? Where's his Bat-package?

|

Byrdibyrd private msg quote post Address this user | |

Quote:Originally Posted by EbayMafia Thank you!! Like I said, my area of expertise is NOT taxes. I appreciate the correction. |

||

| Post 16 • IP flag post | ||

Collector Collector

|

Doc_Cop private msg quote post Address this user | |

| Bottom line, I'm gonna stick to private sales and selling at conventions and keep as much as I can as cash transactions. This has gotten a bit ridiculous in my humble opinion. Nuff said... | ||

| Post 17 • IP flag post | ||

I'm waiting.... (tapping fingers). I'm waiting.... (tapping fingers).Splotches is gettin old! |

Nuffsaid111 private msg quote post Address this user | |

| @Doc_Cop amen to this! | ||

| Post 18 • IP flag post | ||

past performance is no guarantee of future actions. past performance is no guarantee of future actions.

|

KatKomics private msg quote post Address this user | |

| Find a tax haven...isle of man, cayman islands, mairitius etc....open a bank account there...funnel all sales through that account....every few years go on vacation to that country...spend your money or bring it back...but only like 9k at a time or you will have to declare it (is it still 9k??) | ||

| Post 19 • IP flag post | ||

If the viagra is working you should be well over a 9.8. If the viagra is working you should be well over a 9.8.

|

xkonk private msg quote post Address this user | |

| When you talk to a tax professional, ask if they've read the Panama and/or Paradise Papers. Maybe it'll give them some ideas. | ||

| Post 20 • IP flag post | ||

Maybe they just like me better. Nah, that's not it. Maybe they just like me better. Nah, that's not it.

|

BPaxson002 private msg quote post Address this user | |

| Unless you set up a sperate business entity (Sole Proprietorship, LLC, what have you) any cash you get will be considered personal income on your tax form. Now you can deduct inventory purchases as an expense, but you have to have receipts and from something you bought 20 years ago, that may be a bit difficult. There is something about converting personal property, but as it has been mentioned above, you really need a tax specialist. |

||

| Post 22 • IP flag post | ||

Collector Collector

|

cesidio private msg quote post Address this user | |

Quote:Originally Posted by Towmater For some of us it started this year on the state level. |

||

| Post 23 • IP flag post | ||

I've spent years perfecting my brand of assholery. I've spent years perfecting my brand of assholery.

|

DrWatson private msg quote post Address this user | |

Quote:Originally Posted by cesidio Well, some of us have always paid insurance, sales tax, business tax, personal property tax, property tax and income tax on our business and profits. So, as far as I am concerned, it's about time everyone else paid their share as well. |

||

| Post 24 • IP flag post | ||

Captain Accident Captain Accident

|

the420bandito private msg quote post Address this user | |

| So for 2022 everyone should short eBay stock and invest in flea markets. | ||

| Post 25 • IP flag post | ||

Collector Collector

|

cesidio private msg quote post Address this user | |

Quote:Originally Posted by the420bandito OR garage/yard sales |

||

| Post 26 • IP flag post | ||

Collector* Collector*

|

Towmater private msg quote post Address this user | |

| I don't think eBay is going to be happy. I'm glad the flippers will have to either pay taxes (which they should be doing and may be) or they will be seeking other avenues to sell their items. Noting that in our area the convention centers now require sellers to provide their tax information for sales tax reporting and payment purposes it should be easier for cross checking to happen in an audit. |

||

| Post 27 • IP flag post | ||

past performance is no guarantee of future actions. past performance is no guarantee of future actions.

|

KatKomics private msg quote post Address this user | |

| Do you guys have probate/estate tax?? Best option is to die - have your estate pay 1% (that's the rate where I am) on the assessed value then their new tax base is that value - they can sell all books immediately and deduct any brokerage fees etc. and will end up paying little to no tax on the sale. Or....what are your tax rates for gifts?? We can gift up to $15,000 annually with no impact (to as many people as you want) - so assess the value of the collection - gift it to a child or spouse - or better yet a relative on their death bed where you are the sold beneficiary. Gift now and again in Jan - hope they die in Feb - pay the estate tax $300 - get $30k in books back -sell with no income! Say sales are $35k - cost of good sold is $30k plus selling fees = no income!! |

||

| Post 28 • IP flag post | ||

Collector Collector

|

cesidio private msg quote post Address this user | |

Quote:Originally Posted by DrWatson That's the problem most of us that do this for a living or side job are getting squeezed. Big difference between starting to pay the taxes on 600 than starting to pay on 20000+. This is going to be a mess. Anyone that does more than 600 in sales should really talk to a tax pro. |

||

| Post 29 • IP flag post | ||

Masculinity takes a holiday. Masculinity takes a holiday.

|

EbayMafia private msg quote post Address this user | |

Quote:Originally Posted by DrWatson I have complex feelings about the subject. The fact that people are willing to buy and sell on Ebay with 10% seller fees and 10% sales tax tells me that there is a fair number that people are willing to pay for a clean, simple process. When you start adding in a state and federal income tax and make people track every detail of their hobby...for small players I think it just gets to be too much and too complicated. So they will either disappear or go to the black market. it won't do anything to the bigger players they have always been past the minimum reporting requirements and have their systems in place. I just wonder what the fair share/fair process is for the small time hobbyist who is dealing with less than $20,000 per year in sales and purchases. Quote: Originally Posted by the420bandito I've thought about the hit to Ebay. The information I would like to know is what percentage of their revenue comes from dealers doing between $600 and $20,000 per year? And of those, what percentage don't currently report their sales as part of their overall income? If that is a big number, short Ebay stock. If that is a small number, they shouldn't be too worried. And the smart money doesn't seem to be overly worried about it. |

||

| Post 30 • IP flag post | ||

This topic is archived. Start new topic?