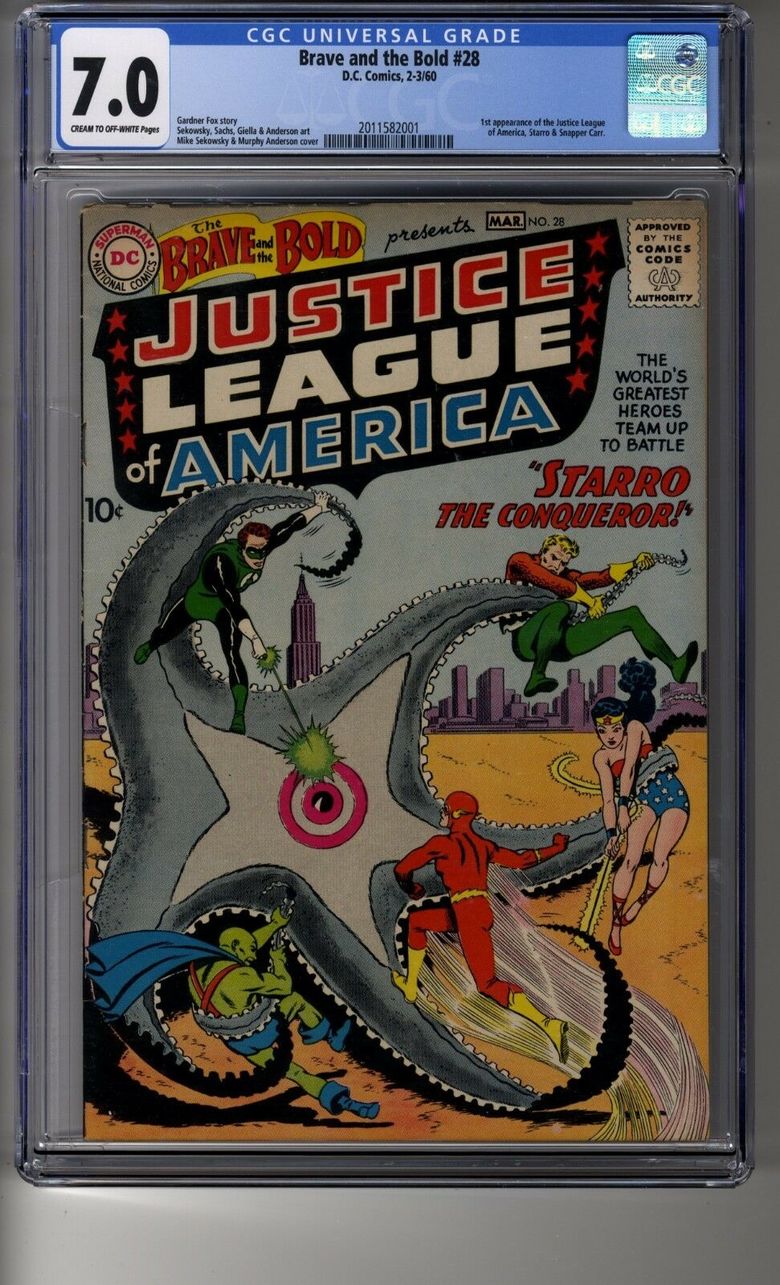

B&B 28 My Biggest Sale to Date14353

I had no way of knowing that 9.8 graded copies signed by Adam Hughes weren't what you were looking for. I had no way of knowing that 9.8 graded copies signed by Adam Hughes weren't what you were looking for.

|

drchaos private msg quote post Address this user | |

| Just sold the biggest book in my inventory topping my previous record of $8,000 on the Tessie the Typist 5. This beauty will go out to its new owner later today:  |

||

| Post 1 • IP flag post | ||

Collector Collector

|

vision6797 private msg quote post Address this user | |

| Awsome, love the cover | ||

| Post 2 • IP flag post | ||

Collector Collector

|

TheLJ private msg quote post Address this user | |

| Congrats!!! | ||

| Post 3 • IP flag post | ||

I have a problem with fattening women up. I have a problem with fattening women up.

|

Bronte private msg quote post Address this user | |

| Is it rude to ask what you sold it for? | ||

| Post 4 • IP flag post | ||

I had no way of knowing that 9.8 graded copies signed by Adam Hughes weren't what you were looking for. I had no way of knowing that 9.8 graded copies signed by Adam Hughes weren't what you were looking for.

|

drchaos private msg quote post Address this user | |

Quote:Originally Posted by Bronte Sold for $11,125 on ebay plus it looks like the buyer got whacked with sales tax. |

||

| Post 5 • IP flag post | ||

Collector Collector

|

Briten private msg quote post Address this user | |

| Nice book and a good sale. | ||

| Post 6 • IP flag post | ||

I had no way of knowing that 9.8 graded copies signed by Adam Hughes weren't what you were looking for. I had no way of knowing that 9.8 graded copies signed by Adam Hughes weren't what you were looking for.

|

drchaos private msg quote post Address this user | |

Quote:Originally Posted by Briten Thanks! The book dipped after the movie came out but the cream always rises to the top. |

||

| Post 7 • IP flag post | ||

Collector Collector

|

Doc_Cop private msg quote post Address this user | |

| Congrats! Another reminder, I am far from being a player in very big boy books! Ouch on the sales Tax! Lastly, when you start selling books in the thousands, does IRS get notified? Is there a magic number to stay under not to pay income tax? | ||

| Post 8 • IP flag post | ||

I had no way of knowing that 9.8 graded copies signed by Adam Hughes weren't what you were looking for. I had no way of knowing that 9.8 graded copies signed by Adam Hughes weren't what you were looking for.

|

drchaos private msg quote post Address this user | |

Quote:Originally Posted by Doc_Cop Since I am doing this full time the IRS is getting their cut. The only sure things in life . . . |

||

| Post 9 • IP flag post | ||

Why just the women? I like bears. Why just the women? I like bears.

|

Gaard private msg quote post Address this user | |

| Aren't you worried about selling expensive items on Ebay? I'd be so worried about being scammed. | ||

| Post 10 • IP flag post | ||

Collector Collector

|

Doc_Cop private msg quote post Address this user | |

| Ahh. I have 2 more years of working for the man and then hope to make this hobby a more full time hobby. Thanks. | ||

| Post 11 • IP flag post | ||

I had no way of knowing that 9.8 graded copies signed by Adam Hughes weren't what you were looking for. I had no way of knowing that 9.8 graded copies signed by Adam Hughes weren't what you were looking for.

|

drchaos private msg quote post Address this user | |

Quote:Originally Posted by Doc_Cop I planned to keep working for the man until my job lost me. Looking back it was for the best. |

||

| Post 12 • IP flag post | ||

I have a problem with fattening women up. I have a problem with fattening women up.

|

Bronte private msg quote post Address this user | |

| @Doc_Cop I think that this year is the final year where the 20k AND 200 sales will yield a tax form at the end of the year. From my understanding, after this year anything over 250 will yield a tax form. |

||

| Post 13 • IP flag post | ||

Collector Collector

|

Doc_Cop private msg quote post Address this user | |

| Thanks Bronte, exactly what I was looking for. | ||

| Post 14 • IP flag post | ||

I have a problem with fattening women up. I have a problem with fattening women up.

|

Bronte private msg quote post Address this user | |

| @Doc_Cop My number was off on next year's selling. It's 600$ Here is link to more information. A provision the 2021 Rescue Plan Act would lower the threshold considerably - it would require companies to send a 1099K to sellers for whom they've processed over $600, period. In our reading of the bill's language, it appears if you sell $601 worth of items, even in a single transaction, the payment processor is required to file Form 1099K. https://www.ecommercebytes.com/C/abblog/blog.pl?/comments/2021/3/1615153514.html |

||

| Post 15 • IP flag post | ||

Captain Accident Captain Accident

|

the420bandito private msg quote post Address this user | |

| I was pretty much done selling on ebay already. This will be the final nail in the coffin. Selling on the forum (ie. private sales) is the future. | ||

| Post 16 • IP flag post | ||

I have a problem with fattening women up. I have a problem with fattening women up.

|

Bronte private msg quote post Address this user | |

| @the420bandito For small sales sure. But what about larger books? I have a hulk 181 on ebay that got an offer for 11k last night. I sincerely doubt that a lota folks on tbe board will have that kinda of money they can just splurge and buy.... |

||

| Post 17 • IP flag post | ||

Collector Collector

|

Doc_Cop private msg quote post Address this user | |

| Wow! that put a damper on things. Thanks so much for the research. Looks like I'll be blowing books out before years end! | ||

| Post 18 • IP flag post | ||

|

|

GAC private msg quote post Address this user | |

Quote:Originally Posted by Bronte and that's the neccessary evil that eBay is. For smaller and mid priced books the forum is 100% the place to be but when prices start getting high, your buying market shrinks. |

||

| Post 19 • IP flag post | ||

Rock, Paper, Scissors, Lizard, Spock Rock, Paper, Scissors, Lizard, Spock

|

Tedsaid private msg quote post Address this user | |

| Congratulations! What a fantastic book, too. It's been on my wish list for years, but far outside my range (for now). | ||

| Post 20 • IP flag post | ||

I had no way of knowing that 9.8 graded copies signed by Adam Hughes weren't what you were looking for. I had no way of knowing that 9.8 graded copies signed by Adam Hughes weren't what you were looking for.

|

drchaos private msg quote post Address this user | |

Quote:Originally Posted by Tedsaid The 6.5 is still available. |

||

| Post 21 • IP flag post | ||

How do I know this? Because I've done it myself. How do I know this? Because I've done it myself.

|

lawguy1977 private msg quote post Address this user | |

| Bronte is spot on. If you're a business and doing sales, it shouldn't be as much of an issue because you're tracking all of the money you've invested or spent (or lost) while conducting the business -- so hopefully you can balance it out with showing your losses. It's also not a huge issue if you can prove you're selling something for the same amount or as a loss. But if you sell something for a gain, the IRS wants their capital gains tax, which is between 15 to 25 percent. So if you're like me, who just sells books to buy other books as a hobby and gets lucky every now and then with a find in the wild or has something from 10-20 years ago that is suddenly hot (or 5 days ago, whatever, this market is crazy), it's a giant pain because I don't take the time to track how much I spend on every book. Or more likely, I paid the cover price and now am selling it for more, and I don't have any business expenses to claim to balance out the gain. Basically after this year, I won't be selling anymore on Ebay, MCS, Facebook Marketplace, etc. I've heard from other sellers that even Instagram is starting to flag the word "claim" in comments because of the claim sales going on there, too. Anyway, I'm not surprised by it. The IRS knows it's losing revenue through online sales, and it's finally catching up to that fact. Maybe I'll get a business license to write off my comic book addiction...I mean, hobby. |

||

| Post 22 • IP flag post | ||

Masculinity takes a holiday. Masculinity takes a holiday.

|

EbayMafia private msg quote post Address this user | |

Quote:Originally Posted by Bronte So sell what you want to sell in 2021, because 2022 will be the year where we can finally rationalize and justify having a "Permanent Collection". |

||

| Post 23 • IP flag post | ||

past performance is no guarantee of future actions. past performance is no guarantee of future actions.

|

KatKomics private msg quote post Address this user | |

| Not to high jack things...I wonder how this 1099K form will work for Canadians? IRS might get my address but I have no SSN and they don't have my SIN #(social insurance number) - so no way for CRA (Canada Revenue Agency) to know about it! Pretty sure if you are selling used personal property with no goal to generate a profit. In such instances, you do NOT need to report sales to CRA unless your worldwide annual sales exceed $30,000 Think I would be on the hook for capital gains which are taxed at 1/2 the rate of normal income though Even that...I think in Canada only sales of used personal items (individual items) over $1000 require you to pay capital gains...but only on the amount over $1000 So far no comic sales over that amount for me...if there were I would likely have grading etc. to reduce the amount over the $1k mark...again though...I think it all hinges on me actually reporting it though...and that will 100% happen...wink, wink!! |

||

| Post 24 • IP flag post | ||

Captain Accident Captain Accident

|

the420bandito private msg quote post Address this user | |

Quote:Originally Posted by Bronte I don't know. I sold 2 keys on here for $5000+ via private message with no issue. The only change in the future would be to cut out PayPal and resort to checks/cash (or Bitcoin!). |

||

| Post 25 • IP flag post | ||

Collector* Collector*

|

Towmater private msg quote post Address this user | |

Quote:Originally Posted by Bronte ..and that leads to capital gains tax I've been writing about. Hope everyone has been keeping excellent records on what you paid for the books you are selling. The above will lead to less sales online. Less GO Collect data. More person to person and sales at conventions. Add in the other things like people going back to work and this year will be the end of the bubble. |

||

| Post 26 • IP flag post | ||

Masculinity takes a holiday. Masculinity takes a holiday.

|

EbayMafia private msg quote post Address this user | |

Quote:Originally Posted by Towmater Keep in mind that the sales are offset by more than just the purchase price. It can also be any related expenses of attending conventions, traveling for comics, etc. The actual physical documentation only becomes important if you were to get audited. When I buy books I enter them into GoCollect with the total purchase price including sales tax, shipping, as well as pressing and slabbing when applicable. Also books purchased online will have a record somewhere in the cloud, but it's nice to have everything in one place when you need it. 95% of us will be taken at our word by the IRS unless we start making nonsense claims for expenses. |

||

| Post 27 • IP flag post | ||

I have a problem with fattening women up. I have a problem with fattening women up.

|

Bronte private msg quote post Address this user | |

| I don't know if its a good problem to have but most of my purchases were extremely cheap compared to prices now. I am going to get railed even if I provide receipts of books purchased. =( | ||

| Post 28 • IP flag post | ||

I’m Kinda Married To A Celebrity. I’m Kinda Married To A Celebrity.

|

00slim private msg quote post Address this user | |

| @EbayMafia If you don’t mind my asking, will you be rolling some of that profit into another mega key? If so, it’ll be interesting to see what you snag next. | ||

| Post 29 • IP flag post | ||

Collector* Collector*

|

Towmater private msg quote post Address this user | |

Quote:Originally Posted by EbayMafia If you’ve even been through an audit then you would be so flippant as your post indicates. Personally, I’ve never been a big SWAG type of guy and would never be that when my character could be called into question. I can’t imagine betting that the IRS would take my word for anything. Having documentation and receipts are the only way to do that honestly and the only way the CPA firm that does our taxes would put anything down on paper for us to sign. That firm would not defend our taxes with us if the IRS came knocking if we did it some other way. Apparently your mileage varies. |

||

| Post 30 • IP flag post | ||

This topic is archived. Start new topic?