New Ebay Rules for shipments to UK13460

Pages:

1

I had no way of knowing that 9.8 graded copies signed by Adam Hughes weren't what you were looking for. I had no way of knowing that 9.8 graded copies signed by Adam Hughes weren't what you were looking for.

|

drchaos private msg quote post Address this user | |

| I just got the message below from ebay. As a member of their global shipping program people living in the UK are able to buy my books on ebay. I wanted to share this message from ebay here as I am not sure if it impacts those selling on ebay from the US. I am pretty sure I am not the only one confused by this ============================================================== eBay New tax laws for UK imports effective January 1, 2021. Update your affected listings. Hello saddlerivercomics, Starting January 1, 2021, eBay will be legally required to begin collecting and remitting value-added tax (VAT) for consignments (shipments of goods) imported into the UK with a value of up to £135. eBay will charge buyers the applicable VAT amount directly and remit this sum to the UK Tax authorities. U.S. sellers who create listings on the UK or any EU site and who trade with UK buyers will need to provide both gross price (i.e., the item price including VAT) as well as the applicable VAT rate used to calculate the gross price on all listings. If sellers do not specify gross price and VAT rate, or if sellers specify a VAT rate of 0%, eBay will assume that the price provided is the net price (i.e., the item price excluding VAT), and eBay will calculate the gross price that is displayed to buyers. We strongly urge sellers listing on eBay.co.uk or any EU site to update their existing listings to include applicable VAT rates as soon as possible. All new listings should include a VAT rate. You will find the field for the VAT rate beside the price when you create or edit listings. What you need to know: - Starting January 1, 2021, eBay will start to collect and remit VAT for UK imports on all consignments with a value of up to £135. There will no longer be a VAT exemption for small consignments up to £15. - In cases where the seller is a non-UK business and the goods are already in the UK, eBay will collect and remit VAT for goods sold to consumers within the UK, regardless of their value. - Sellers should begin listing the applicable VAT rates on all their existing and new listings as soon as possible. - Starting March 1, 2021, a VAT rate will also be required on all EU sites when listing items. To see the latest information on the upcoming changes, please visit UK Seller Center 2021 VAT Changes: https://sellercentre.ebay.co.uk/global-sales/2021-vat-changes This email is not intended as tax or legal advice. We recommend that you seek independent tax or legal advice to ensure compliance with applicable laws and regulations. Thank you for selling on eBay, Your eBay Team |

||

| Post 1 • IP flag post | ||

I'm waiting.... (tapping fingers). I'm waiting.... (tapping fingers).Splotches is gettin old! |

Nuffsaid111 private msg quote post Address this user | |

| I got the same message and, you betcha, I'm confused. I am not sure why, when any new regulation comes about from any source, that they can't translate their lengthy diatribe into concepts we can all understand. It's always lawyer talk that somehow I have to figure out later. |

||

| Post 2 • IP flag post | ||

I had no way of knowing that 9.8 graded copies signed by Adam Hughes weren't what you were looking for. I had no way of knowing that 9.8 graded copies signed by Adam Hughes weren't what you were looking for.

|

drchaos private msg quote post Address this user | |

Quote:Originally Posted by Nuffsaid111 What I want make sure of is that I do not end up eating these new custom fees if someone from the UK buys one of my books. If anyone has this figured out, please chime in. |

||

| Post 3 • IP flag post | ||

Collector Collector

|

no1lufcfan private msg quote post Address this user | |

| @drchaos it's all a bit of a nightmare. I got a similar message from eBay over a month ago for UK/IE/EU sellers and it appears we are going to get clobbered. I also pay 22% tax on eBay fees and my last sale of £59 to USA I had to swallow a £9 sales tax  |

||

| Post 4 • IP flag post | ||

Please continue to ignore anything I post. Please continue to ignore anything I post.

|

southerncross private msg quote post Address this user | |

| I don't do eBay but what I read if you list books for sale in the UK or sell a book there the vat needs to be added or the vat is taken from the amount it sold so less money in your pocket if you didn't add vat. Or I maybe wrong. Maybe there is an accountant in the forums who can better understand this  |

||

| Post 5 • IP flag post | ||

I had no way of knowing that 9.8 graded copies signed by Adam Hughes weren't what you were looking for. I had no way of knowing that 9.8 graded copies signed by Adam Hughes weren't what you were looking for.

|

drchaos private msg quote post Address this user | |

Quote:Originally Posted by no1lufcfan From what I read the sellers in Europe are getting hit for sure. It is sellers in the US that are participating in the global shipping program that I am confused about. The allure of this program for sellers in the US is that we don't have to deal with overseas shipping costs including customs as ebay hits the buyer for all of it behind the scenes. This may or may not be a departure from the simplicity we enjoy and expect from this program. Hopefully someone here has this thing figured out. |

||

| Post 6 • IP flag post | ||

|

|

cyrano0521 private msg quote post Address this user | |

| EBay will ADD a VAT amount to whatever sales figure you list UNLESS you indicate VAT is already included and at what % used. | ||

| Post 7 • IP flag post | ||

I had no way of knowing that 9.8 graded copies signed by Adam Hughes weren't what you were looking for. I had no way of knowing that 9.8 graded copies signed by Adam Hughes weren't what you were looking for.

|

drchaos private msg quote post Address this user | |

Quote:Originally Posted by cyrano0521 So now we have to change all of our listings to reflect this. Terrific! |

||

| Post 8 • IP flag post | ||

If the viagra is working you should be well over a 9.8. If the viagra is working you should be well over a 9.8.

|

xkonk private msg quote post Address this user | |

| I don't think you do. I'm only going by what you posted but Quote: Originally Posted by drchaos are you creating listings specifically on the .uk or .whatever sites? If not it sounds like you're off the hook from the get-go. Quote: Originally Posted by drchaos If you do nothing, it sounds like eBay will fix it for you. Kind of like I assume it already does if you charge calculated shipping and/or global shipping. Different buyers see different numbers even if you don't do anything. FWIW, I haven't gotten a message about this although I have sold one or two items via global shipping. Maybe it's just because you have a store? I'm sure eBay has a responsibility to tell people it could affect even if it doesn't necessarily affect them. |

||

| Post 9 • IP flag post | ||

Collector Collector

|

poka private msg quote post Address this user | |

| Comics are zero VAT goods in the UK so will be interesting so see whether ebay is going to add VAT This topic is being discussed in the ebay community https://community.ebay.co.uk/t5/Business-Seller-Board/Changes-to-VAT-2021/td-p/6736856 |

||

| Post 10 • IP flag post | ||

Collector Collector

|

no1lufcfan private msg quote post Address this user | |

| @poka thanks for the link. I read the first of 4 pages approx 20 posts....and left with a headache |

||

| Post 11 • IP flag post | ||

Ima gonna steal this and look for some occasion to use it! Ima gonna steal this and look for some occasion to use it!

|

IronMan private msg quote post Address this user | |

| I too am a USA seller that participates in the Global shipping program. But I ONLY list items for sale on the eBay USA site. (www.ebay.com) I do not create listings for eBay's UK site (www.ebay.uk) So this change has no affect on me and will only affect those that actually put listings on eBay's UK site. |

||

| Post 12 • IP flag post | ||

Collector Collector

|

poka private msg quote post Address this user | |

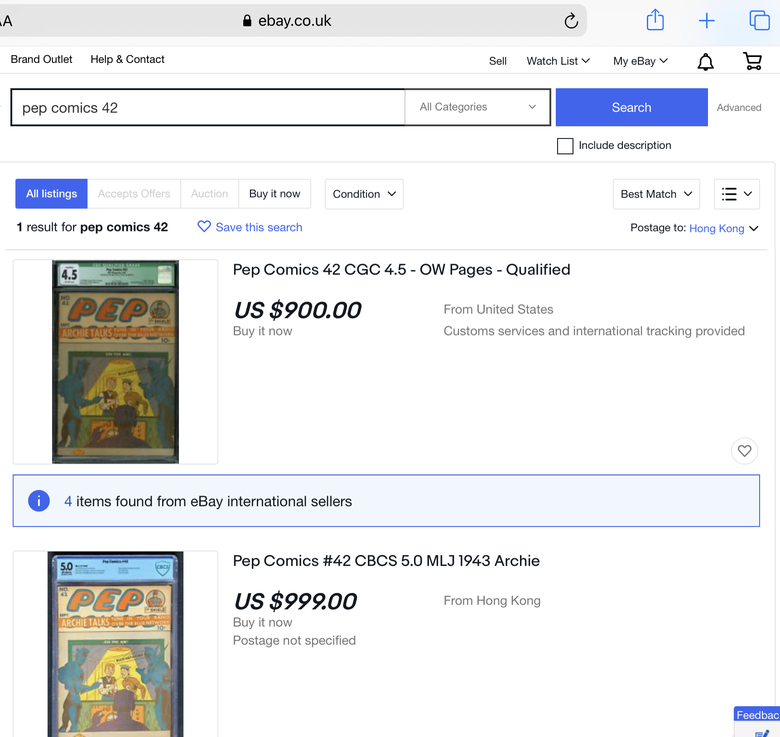

Quote:Originally Posted by IronMan You ought to try to go to eBay.co.uk to see whether your listings are shown there. I am pretty sure you will find your listings there. Just like mine  |

||

| Post 13 • IP flag post | ||

Ima gonna steal this and look for some occasion to use it! Ima gonna steal this and look for some occasion to use it!

|

IronMan private msg quote post Address this user | |

| @poka Yes, you are correct. eBay has my books listed on the ebay.uk site. I guess I'll just do nothing until they tell me I need to do something. |

||

| Post 14 • IP flag post | ||

Collector Collector

|

poka private msg quote post Address this user | |

| UK buyers - be warned. eBay now adds import charges for comic book purchases less than gbp135 if you buy from non-uk based sellers. Even those there is no charge in uk for comics. |

||

| Post 15 • IP flag post | ||

Collector Collector

|

poka private msg quote post Address this user | |

Quote:Originally Posted by IronMan Think you find that your listings have been removed now from the UK website |

||

| Post 16 • IP flag post | ||

Collector Collector

|

no1lufcfan private msg quote post Address this user | |

| eBay is becoming a total nightmare for sales and purchases depending where you live and your account is based. My last sale to USA I was charged approx 15% sales tax. My last purchase from US I was charged 15% customs for the first time ever. Now eBay are charging VAT ??? If only ebid sales were stronger I would be off like a shot |

||

| Post 17 • IP flag post | ||

|

|

cyrano0521 private msg quote post Address this user | |

| Yes, those were the new rules eBay instituted as of Jan 1. You have to tell them if your listings already include taxes or not. If they do, then taxes are deducted from your price, if they do jot, then taxes are added. Like sales taxes in the USA, the UK has a new rule about VAT to make sure the gov’t gets its cut. | ||

| Post 18 • IP flag post | ||

Collector Collector

|

poka private msg quote post Address this user | |

Quote:Originally Posted by cyrano0521 that option is only available for EU sellers not US sellers. btw - there is no cut for comic books in UK but ebay ignores that |

||

| Post 19 • IP flag post | ||

Collector Collector

|

Kinsella5 private msg quote post Address this user | |

| This doesn't surprise me, the UK from what my international customers tell me is notorious for wanting every penny they can get out of their people for importing goods. The VAT taxes are generally collected at the time of delivery, resident is notified of a package and they attempt to collect when they deliver, if the receiver isn't home, they pick up a their post office and pay the VAT at that time. This could be a result of sellers not declaring for the full declared value, trust me, this will all result in higher fees for the sellers here in the USA, since eBay will look at it as the performing a service for the seller. It is basically what is going on now for sellers in the USA selling to USA buyers with eBay collecting the sales tax and paying on behalf of the seller here in the USA, there used to not be a fee on the seller for that, now there is if you dig deeper. Every possible way eBay can suck another penny out of a seller, they will. Also the final auction fee now is not only based on the final value, plus the fee on the shipping costs, but they now determine the final auction value fee as "item sold price + sales tax collected + shipping costs" so if a person sells something for $10, and an added $4 for shipping, and then a sales tax on that ten dollars of let's say $1, the final auction fee is based on $11 and then a fee on the $4 shipping. |

||

| Post 20 • IP flag post | ||

Collector Collector

|

poka private msg quote post Address this user | |

| there is a difference between US and UK in the sense that sales tax applies to comics in the US whereas the VAT rate for comics in UK is 0 - yet Ebay now charges VAT for UK based buyers even though they are not supposed to. | ||

| Post 21 • IP flag post | ||

Pages:

1This topic is archived. Start new topic?