The Nostomania 500 Comic Book Stock Index13034

PEDIGREED... Again! PEDIGREED... Again!

|

martymann private msg quote post Address this user | |

| Be sure to check-out this interesting site that measures the performance of some 500 comic books. It also contains some 500 cover images plus details of the book that are fun to read. Marty |

||

| Post 1 • IP flag post | ||

Collector Collector

|

vacaboca private msg quote post Address this user | |

| @martymann, do you have a direct link to the 500-comic index? I found a top 100, but haven't found what you're referring to... looking forward to seeing it! | ||

| Post 2 • IP flag post | ||

PEDIGREED... Again! PEDIGREED... Again!

|

martymann private msg quote post Address this user | |

| @vacaboca I am not sure but I believe that you might have to be a Premium Account Subscriber to be able to access the index. I am checking with the powers to be at NOSTOMANIA to see if this is the case. Marty |

||

| Post 3 • IP flag post | ||

Collector Collector

|

vacaboca private msg quote post Address this user | |

Quote:Originally Posted by martymann That might be a good way to get me to try out premium - let us know |

||

| Post 4 • IP flag post | ||

Collector Collector

|

TommyJasmin private msg quote post Address this user | |

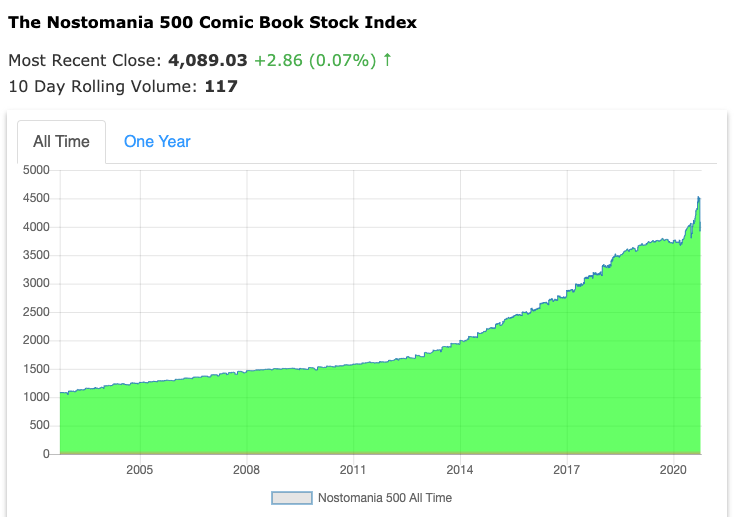

| Hi @vacaboca - Marty asked me to post a link to the Nostomania 500 Comic Book Stock Index. Hey @martymann! The only thing you don't get to view if you are not a paying member is the actual chart. Anybody can see the daily close and rolling volume, and all 500 issues. Once I was fairly confident I had the algorithm correct (very similar to how the S&P 500 is computed), a few things became immediately clear to me. Our hobby is nearly recession proof. Click the S&P 500 link and view the "Max" (all-time) chart. You see the big drops during the 2008 housing market crash, and at the onset of the coronavirus pandemic. On my index, there is a slight downward dip during March and April of this year, but remarkably, the comic book market has not only rebounded but surged. I'll drop a screenshot here. I'm happy to answer any questions as always, either here or on Nostomania.  |

||

| Post 5 • IP flag post | ||

Collector Collector

|

vacaboca private msg quote post Address this user | |

Quote:Originally Posted by TommyJasmin Very cool - definitely something I find interesting, I'll have to check it out. Thank you for the information! |

||

| Post 6 • IP flag post | ||

PEDIGREED... Again! PEDIGREED... Again!

|

martymann private msg quote post Address this user | |

| Happy to see that I have 13 books on this list. mm |

||

| Post 7 • IP flag post | ||

Masculinity takes a holiday. Masculinity takes a holiday.

|

EbayMafia private msg quote post Address this user | |

Quote:Originally Posted by martymann Very cool, I'm going to enjoy digging into this. Thanks for bringing it to our attention. I can see a couple Silver Age books already that I have 3-4 copies of. |

||

| Post 8 • IP flag post | ||

PEDIGREED... Again! PEDIGREED... Again!

|

martymann private msg quote post Address this user | |

Quote:Originally Posted by EbaySeller Could be interesting to see how many others have books on the list. mm |

||

| Post 9 • IP flag post | ||

Collector Collector

|

Terry88 private msg quote post Address this user | |

| I have 27. So I guess I'm not that terrible of a collector (albeit, that's a tiny percentage of all the books What I found most interesting about the article is the statement that these high risk investments seem to be recession resistance. I don't really understand that. If you're in a recession, it's likely that unemployment is up, people will likely spend less, so who is buying that keeps the price high. I would expect more dips during less optimal times, the same as any market, as more people are looking to move that Spidey 300... If volume is up then price usually comes down accordingly. I'd love to read more into this side of the hobby. |

||

| Post 10 • IP flag post | ||

Moderators handing out titles: Boom. Roasted. Moderators handing out titles: Boom. Roasted.

|

Hcanes private msg quote post Address this user | |

| Thanks for sharing this list. Gives me more motivation to move my Marvel Spotlight 2. I have about 5% of the list not counting doubles. I noticed it did not have moderns such as the Walking Dead 1 and NYX 3 which fetch a premium. It is probably for the best to keep it from Golden to Copper Age to prevent high volatility. ASM 238 - 8.5 CPV ASM 300 -7.0 Newsstand Michelinie & Todd signature; 9.0 Newsstand Astonishing Tales 25 - It was a 9.6 and then I believe it came back as a 8.0 after a failed Perez signing Avenger 196 - 8.5 Newsstand Rubinstein, Michelinie, Perez signatures Avengers Annual 10 - 9.4 Newsstand. Golden, Claremont, Al Milgron sigs on first page Captain Britain 1 - 9.2 Marvel Spotlight 2 - 7.0 Neal Adams sig on first page Marvel Super Heroes Secret Wars 8 - 9.2 CPV; 9.6 Newsstand Beatty & Zeck signature Mr. Miracle 1 - 9.0 New Mutants 87 - 9.0 New Mutants 90 - 9.0; 9.6 Liefeld & Nicieza signature New Teen Titans 2 - 9.6 Newsstand Nova 1 - 9.4 Joe Sinnott signature Omega Men 3 - 9.8 Giffen & DiCarlo signature Primer 2 - 9.2 Strange Adventure 205 - 9.2 Twin Cities Pedigree Swamp Thing 1 - 8.0 Swamp Thing 37 - 9.6 Tales of the Teen Titans 44 - 9.6 Uncanny X-Men 266 - 9.6 Newsstand Wolverine Limited 1 - 9.4 Newsstand Miller, Rubinstein, Claremont Signature; 9.8 Newsstand Wolverine 1 - 9.4 CBCS Raw Grade - Nickel City Collection X-men 28 - Pence 8.5 X-Men 120 - Pence 9.0 |

||

| Post 11 • IP flag post | ||

If the viagra is working you should be well over a 9.8. If the viagra is working you should be well over a 9.8.

|

xkonk private msg quote post Address this user | |

| It says that a book has to have existed for the entirety of their data set, so they can't have moderns. One question would be why? Another is what condition they're tracking for these books. My guess for why it's "recession proof" is that a lot of those are old, pricey books. They aren't going down in value because even in a recession the people who buy and sell those books are doing fine. |

||

| Post 12 • IP flag post | ||

Collector Collector

|

50AE_DE private msg quote post Address this user | |

| I got 202 on the list, but mostly lower grades on the SA/GA stuff. | ||

| Post 13 • IP flag post | ||

Masculinity takes a holiday. Masculinity takes a holiday.

|

EbayMafia private msg quote post Address this user | |

Quote:Originally Posted by Terry88 I don't believe for a minute that Comic Books are recession proof. However, I think collectibles in general tend to be bolstered by Stimulus plans, in the same way that the price of gold would be bolstered when a bunch of money is borrowed by governments. So I think comics and other collectibles are initially hit by recessions, but prices quickly recover with the Stimulus plans that tend to follow. Maybe it's not so much that the comic book rises in value as that the dollars used to purchase them fall in perceived value. |

||

| Post 14 • IP flag post | ||

PEDIGREED... Again! PEDIGREED... Again!

|

martymann private msg quote post Address this user | |

Quote:Originally Posted by 50AE_DE WOW! mm |

||

| Post 15 • IP flag post | ||

I live in RI and Rhode Islanders eat chili with beans. I live in RI and Rhode Islanders eat chili with beans.

|

esaravo private msg quote post Address this user | |

| @martymann - I currently have 91 of the comics listed, and have sold or traded away more than another dozen. Pretty cool list. | ||

| Post 16 • IP flag post | ||

Collector Collector

|

TommyJasmin private msg quote post Address this user | |

| Hi @xkonk - Quote: Originally Posted by xkonk Re: why no moderns. @Hcanes made a good point about general volatility. Think about the vetting and qualifications a new company must meet before being listed on a major stock index. But mostly I just wanted all books listed to have existed for our entire sales history - back to around 2002. I realize I could adjust the index to, for example, only represent 497 issues up through 2005 or so, but that didn't feel right. Re: what condition is tracked? A sale for any grade and any certification is counted, weighed against the Nostomania value at time of the sale, for that certification and grade. Restored and signature series sales are discounted - there is too much variance possible for a single comic and grade. E.g., slight to extensive resto, one, two, three signatures - too much price variance. Quote: Originally Posted by xkonk This is an interesting point I hadn't considered. The comments and questions are appreciated. |

||

| Post 17 • IP flag post | ||

Masculinity takes a holiday. Masculinity takes a holiday.

|

EbayMafia private msg quote post Address this user | |

| @TommyJasmin I haven't read the details on the site yet, so I apologize if this question was already answered. Obviously these books were not chosen randomly, what overall objective were you trying to achieve in choosing these particular 500 books? For example, is there a reason why Frontline Combat 10 was chose rather than #9 or #11? | ||

| Post 18 • IP flag post | ||

COLLECTOR COLLECTOR

|

dielinfinite private msg quote post Address this user | |

| @EbaySeller The relevant text from the website Quote: Originally Posted by Nostomania I personally don't have much interest in the list but I do think that excluding moderns is a huge oversight. I believe the newest book on that list is Batman Adventures 12 from 1993, meaning almost 30 years of history are unaccounted for. Assuming the comic book as we know it basically start in 1938 with Action Comics #1, that means out of 82 years of history, 27 years, or nearly 1/3 of its history is unrepresented. Obviously I don't mean to suggest that it all should be weighted equally but that is a huge amount of time and history omitted when even the S&P 500 the list is modeled after has nearly 10% of its list from companies founded in the last 20 years (not including new companies formed from mergers of earlier companies) including 2 from as recently as 2019. |

||

| Post 19 • IP flag post | ||

Collector Collector

|

TommyJasmin private msg quote post Address this user | |

Quote:Originally Posted by EbaySeller No worries @EbaySeller - good question. The overall intent was to fairly represent market share of all genres, but averaged over a long period of time. First consider just the breakdown. How do you decide how much air time to give Romance vs. Super Hero vs. Western vs. Funny Animal, etc. This gets tricky because historically genres ebb and flow. As most of us know, the Super Hero genre had quite a "dead zone" from about 1950 to 1958, with most other types of comics far outselling them. But overall, they have to get the lion's share. As far as which particular books, honestly that was almost entirely subjective on my part. I spoke to a few of the Premium Subscribers who requested the feature for input, but mostly just went on instinct. The only thing I can say is there was some justification for each selection, some thought process. For the Frontline Combat, it probably went something like "ok, I need a sampling of War books. There really should be at least one E.C. in there. So now I'm down to Frontline Combat and Two-Fisted Tales." At this point, I think, "were there standout issues and why?". Often it comes down to the cover. I think I almost went with the Civil War cover, but felt this one was more powerful. So there you go, not an exact science |

||

| Post 20 • IP flag post | ||

Collector Collector

|

TommyJasmin private msg quote post Address this user | |

Quote:Originally Posted by dielinfinite Hi @dielinfinite - so cool I got you to chime in. Your input means a lot to me. If the S&P has 10% companies 20 years and younger, then I think the Nosto 500 should probably mimic that practice. I'm not sure how mergers would apply here, I don't immediately see an applicable analogy. Publishers come and go and merge over time, but a comic is simply printed and distributed. Anyway you make some very good points. You have accurately conveyed my intent that the index represent "around Action #1" and up. I am not counted among those who keep trying to push the definition of "comic book" further and further back, to eventually include cave paintings. To be honest, I did feel something is off by leaving out stuff exactly like what @Hcanes mentioned. Nostomania is just one guy though, me. It takes time to learn how things work under the hood and I just don't understand yet how S&P deals with one company dropping off and a new one taking its place. How they make that transition smooth, with roughly equal weighting at the time of switchover. I'll figure it out and make some adjustments. Thanks! |

||

| Post 21 • IP flag post | ||

COLLECTOR COLLECTOR

|

dielinfinite private msg quote post Address this user | |

| Wikipedia has a section on the selection criteria and while there is a world of difference between the two, it is helpful to understand what goes into their selection I don’t think it is a rule or anything that the S&P 500 has to have a certain percentage of it’s list from a certain period of time, I only mentioned it to highlight how the S&P still manages to include very recent companies among the long-standing entries on its list. |

||

| Post 22 • IP flag post | ||

Collector Collector

|

Terry88 private msg quote post Address this user | |

| Much like a lot of mutual funds and what not, this selections of books, I think, would be considered "more stable" or maybe less affected by swings. They're rare for example, so they don't pop all that often, helping to keep their desirability above most average modern books. Moderns on the other hand, follow more closely a "flavour of the month" type trend - I guess - and so those mutual funds would be the more volatile versions where you might see a lot more monthly/yearly fluctuation. Kinda like a Tech Start-up vs. GE. It makes a lot of sense that GE would be in the top 500 but less sense to include a new company that may or may not go anywhere in the long run. I'm sure a few moderns could be included in the 500 list, books that have shown to be amazing, but I would guess not very many. The list seems sound to me. Two lists and one with a lot more volatile activity would be an interesting comparison. Cross referencing with release dates or entertainment events, announcements, a bad movie, etc., would be really interesting features to superimpose and describe the data and volatility. I'd love more info about each book and why they were chosen. Sups and Bats are pretty obvious, but a lot of the others are not well known - at least to me. (I love data...) |

||

| Post 23 • IP flag post | ||

Masculinity takes a holiday. Masculinity takes a holiday.

|

EbayMafia private msg quote post Address this user | |

| @TommyJasmin I don't know if you address this in the premium section, but in investments Liquidity can be similarly important to price in determining true value. It can work both ways, high liquidity could be valued for safety because its easy to resell. But on the other hand low liquidity could mean unrecognized value if it's because supply is very limited. In the premium section does your list currently import sales volumes as well as prices for the recent time period? Would it be possible currently to sort the list by sales volume? | ||

| Post 24 • IP flag post | ||

Collector Collector

|

TommyJasmin private msg quote post Address this user | |

Quote:Originally Posted by dielinfinite @dielinfinite - yup, I get that - you were not claiming a specific percentage as a rule, just that there is some representation. Again, the clarification is much appreciated. |

||

| Post 25 • IP flag post | ||

Collector Collector

|

TommyJasmin private msg quote post Address this user | |

Quote:Originally Posted by Terry88 @Terry88 - hey, 27 is not bad! Now, your point about tracking with the recession, yes, that was what I expected to see, a reasonable correlation. Interestingly, in my most recent market report, I touch on the same irony regarding ASM 300 you brought up! We've got high unemployment, yet books like that are going gangbusters. Check out the eBay link I used in the 1st paragraph. I can't say I fully understand it, and the explanations posed here are all plausible. |

||

| Post 26 • IP flag post | ||

Collector Collector

|

TommyJasmin private msg quote post Address this user | |

Quote:Originally Posted by EbaySeller Ok, this is good @EbaySeller. This gives me some nice ideas for improving the feature. I do currently note the total, rolling sales volume (that was in the chart I pasted at top of thread), but, your idea to sort by sales volume would be really handy. The info is all there in the database. At the very least, for starters I should note which issues have recent contributing sales and how many. Sorting would be fantastic. Of course all the sales data is available if users drill around the site, but it should be right there next to the issue on the stock index listing. Thanks, great idea. I will have at least some form of this live with the next site update. |

||

| Post 27 • IP flag post | ||

Masculinity takes a holiday. Masculinity takes a holiday.

|

EbayMafia private msg quote post Address this user | |

Quote:Originally Posted by TommyJasmin @TommyJasmin Glad you agree. Once you can sort by both volume and price it will be easy to create comparable traunches to measure over time. For example maybe I would want to follow the 10 highest sales volume books under $100. Or want to compare quarterly growth for the highest volume 50 books vs the lowest volume 50 books. Or maybe I would want to do that same comparison in a specific price range. The opportunities to group and compare really can get quite interesting once liquidity information is available. That would be something I would be interested in. |

||

| Post 28 • IP flag post | ||

Collector Collector

|

vacaboca private msg quote post Address this user | |

| It would be interesting to track volume as well as price - is volume constant in different economic conditions, or not? | ||

| Post 29 • IP flag post | ||

Collector Collector

|

TommyJasmin private msg quote post Address this user | |

Quote:Originally Posted by vacaboca I'll have to think about this one a bit @vacaboca. There are circumstances that might skew the data. For example, major auction events like a Heritage Signature Auction. I might capture 100 sales for index members in a single event which occurs only a few times a year. I think, however, it's still a great point - if you have potentially interesting data, just present it. If something looks odd, let people discuss it, figure it out, there must be a reason for it. I always say outliers are either something really interesting, or something I'm doing wrong. A funny aside (for me anyway, I'm always entertaining myself). When I see "Signature Auction" it reminds me how the 1st comic auction or grading service will come up with a term, then the followers will have to come up with a similar term, but it's never as good. 1st: Heritage -> Signature Auction Some thought went into that. One def: "a distinctive product by which someone can be identified" Later: ComicLink -> Focused Auction (huh?) 1st: CGC -> Universal Grade Later: PGX -> World Grade (really?) |

||

| Post 30 • IP flag post | ||

This topic is archived. Start new topic?